机构洞察:瑞银未来 2 个月将转向战术性看跌(至少下跌 10%)

Institutional Insights: UBS Turning tactically bearish next 2 months(at least-10%)

Market Internal Weekly -

The UBS Head Of US Equities is "turning tactically bearish next 2 months(at least-10%)–IWM, XLF & HYG Hedges"

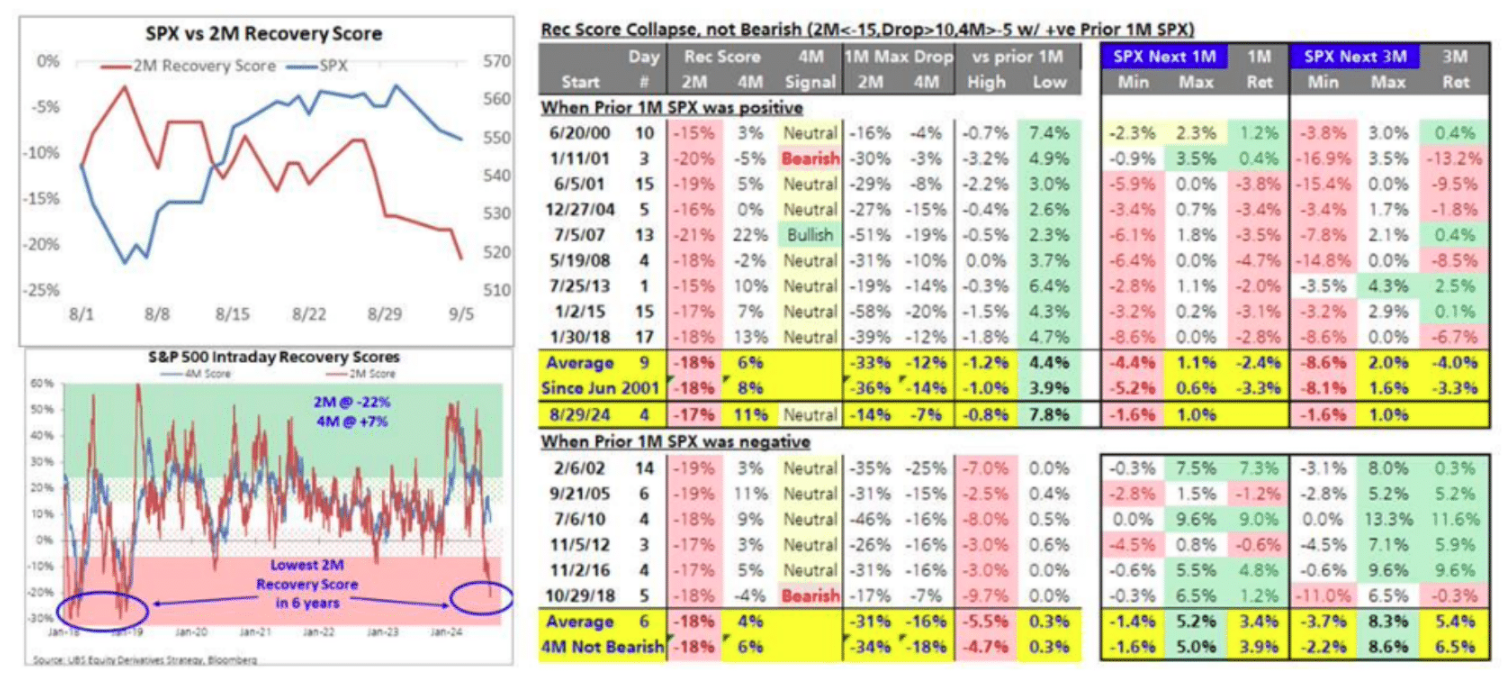

Executive Summary: Over the last two weeks, market internal has deteriorated to be the worst YTD. Current condition is also the most vulnerable in 6 years–which means any small external shock / slight disappointment of data could trigger large unwind.I amtactically bearish for the next 2 months (before Election) on the back of 2M intraday recovery score collapse to 6-year Low, RMM clients sold-the-dip and CTA sell rebalance asymmetry.

This call is more bearish than my email on Tuesday. On Tuesday, I suggested a just-in-case hedge of macro events given neutral recovery score, and I expected a choppy market. Today, I suggested a tail hedge due to 2M recovery score collapse as I expect SPX could be-10%from peak (or-8%from here) within 1 month and-15%within 2 months. However, this is NOT a long-term view unless 4 month recovery score makes a decisive shift. For now, the weak market internal bias suggests that even a slight disappointment in any of the upcoming economic releases could trigger large unwind. On no news event, moderate volume selling could continue in the market.

Investors are on the edge and are vulnerable to any bad news. Given SPX +18%at peak on 8/30 YTD, many investors have had a good year and are ready to cut some risk 2 months before election. This is why sentiment hasn’t turned bearish but the trading behavior is extremely cautious. Any disappointment in the upcoming economic releases could accelerate their modest profit taking behavior to massive unwind

免责声明:提供的材料仅供参考,不应视为投资建议。 本文中表达的观点,信息或观点仅属于作者,而不属于作者的雇主,组织,委员会或其他团体或个人或公司。

过去的业绩不代表未来的结果。

高风险警告:差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。 当与Tickmill UK Ltd和Tickmill Europe Ltd进行差价合约交易时,分别有72%和73%的零售投资者账户亏损。 您应该考虑自己是否了解差价合约的工作原理,以及是否有具有承受损失资金的的高风险的能力。

期货和期权:保证金交易期货和期权具有高风险,可能导致损失超过您的初始投资。这些产品并不适合所有投资者。请确保您完全了解这些风险,并采取适当的措施来管理您的风险。