Will EURAUD Bull Channel Hold?

Testing Key Area

EURAUD is at a crossroads here on the back of the sell off from YTD highs. The market has corrected around 3.5% lower from those 1.74 area highs and is now testing the bull channel lows. EUR has come under heavy selling pressure over recent weeks as a shift in ECB expectations has taken the steam out of the prior bull run. This week, the ECB hikes rates once again, now standing at 4.5% from 4.25% prior. However, along with the hike the bank gave a firm signal that it was looking to hold rates steady going forward, essentially declaring an end to its post-pandemic tightening cycle.

ECB Causes Major FX Shift

Given that the ECB had up until fairly recently been staunchly adamant that it would continue pushing ahead with further hikes until inflation fell back to target, this is a big shift for the macro backdrop. Deteriorating economic conditions in the eurozone and a stronger USD look likely to keep EUR pressured near-term meaning that we could well see a channel break here in the coming days or weeks.

Technical Views

EURAUD

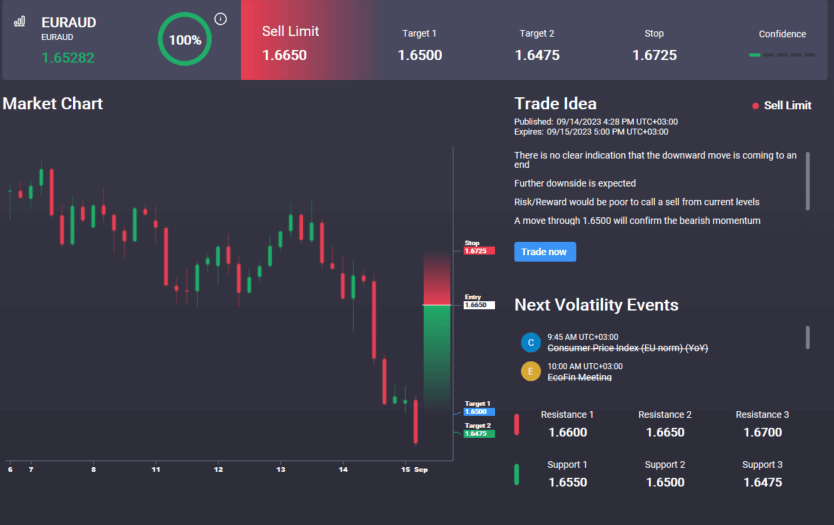

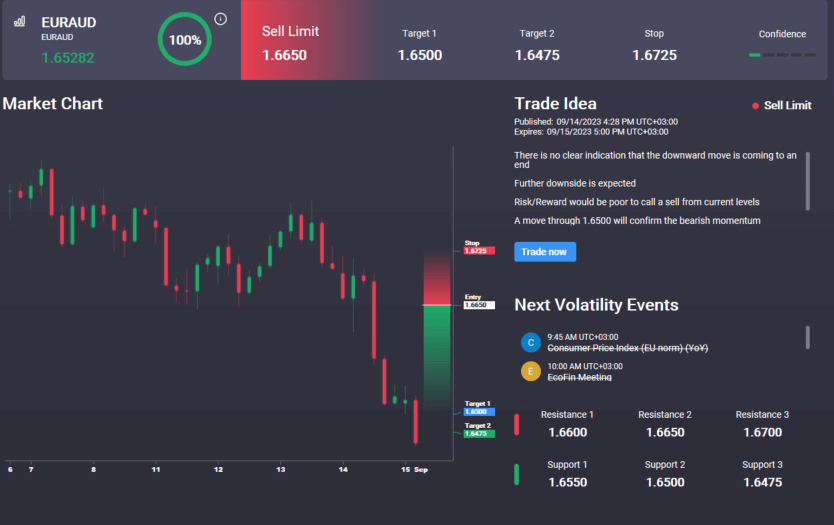

The sell off in EURAUD has seen the market trading back down to retest the area of broke higher between 1.6428 and 1.6589. We also have the bull channel lows in this area also and while this region holds as support, the focus remain son a further push higher in line with the broader bull trend. However, with strong bearish divergence into the recent highs and with momentum studies since turning bearish, risks are now building to the downside with 1.6173 the focus on a break of channel lows. Interestingly, we have a bearish signal in the Signal Centre today set above market at 1.6650 suggesting a preference to sell any bounces from current levels.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.