Trade War Sparks Fresh Gold Buying

Gold Spikes on Safe-Haven Demand

Gold prices have turned firmly higher today with the futures market fast approaching a retest of the YTD highs. The move higher comes amidst an uptick in global trade war fears as Trump actions tariffs against Mexico, Canada and China and China responds with its own retaliatory measures to come into effect from next week. Canada has also responded with its own 25% tariff on around $20 billion worth of US goods to come into effect immediately.

The response has raised concerns that the US and its trading partners will move into a phase of tit-for-tat trade restrictions, amplifying the negative effects of the trade war. Against this backdrop we’re seeing strong safe-haven demand for gold while USD has weakened materially today.

Tariffs & Inflation

Notably, the weakness in USD comes despite the generally held view that trade tariffs will increase inflationary pressure in the US, leading to delayed easing from the Fed. US inflation has been rising recently ahead of these tariffs coming into play, setting the stage for continued rises in consumer prices. Currently, the market is pegging the next Fed easing to take place in June.

However, if we see inflation lifting higher in coming readings, this projection could well start to be pushed further out which should translate into a higher US Dollar. For now, though, safe-haven demand remains the key driver as markets the shift in the global trade landscape, meaning gold prices are likely to push higher near-term.

Technical Views

Gold

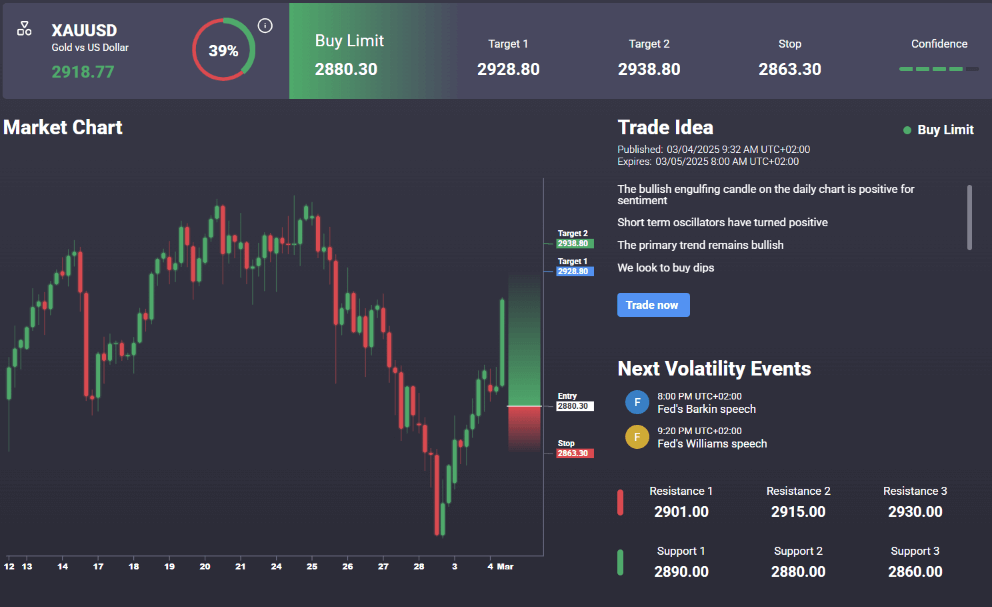

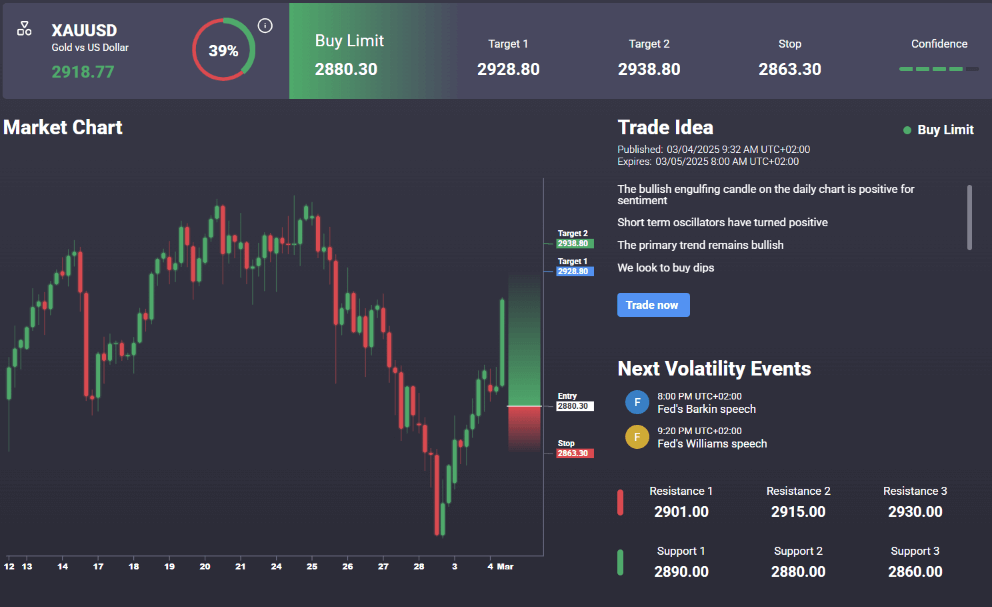

The correction lower in gold has found strong support into the 2,859.15 level with price now turning back up towards the YTD highs. The 2,949.88 level and bull channel highs will now be the next key level to watch with the bullish outlook remaining in place while price holds above 2,859.15. In the Signal Centre today we have a buy limit at 2,880.30 suggesting a preference to stay long into any dips from current levels.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.