The FTSE Finish Line - July 11 - 2023

The FTSE Finish Line - July 11 - 2023

Employment Data Boosts Sterling, Further BoE Action Weighs On FTSE

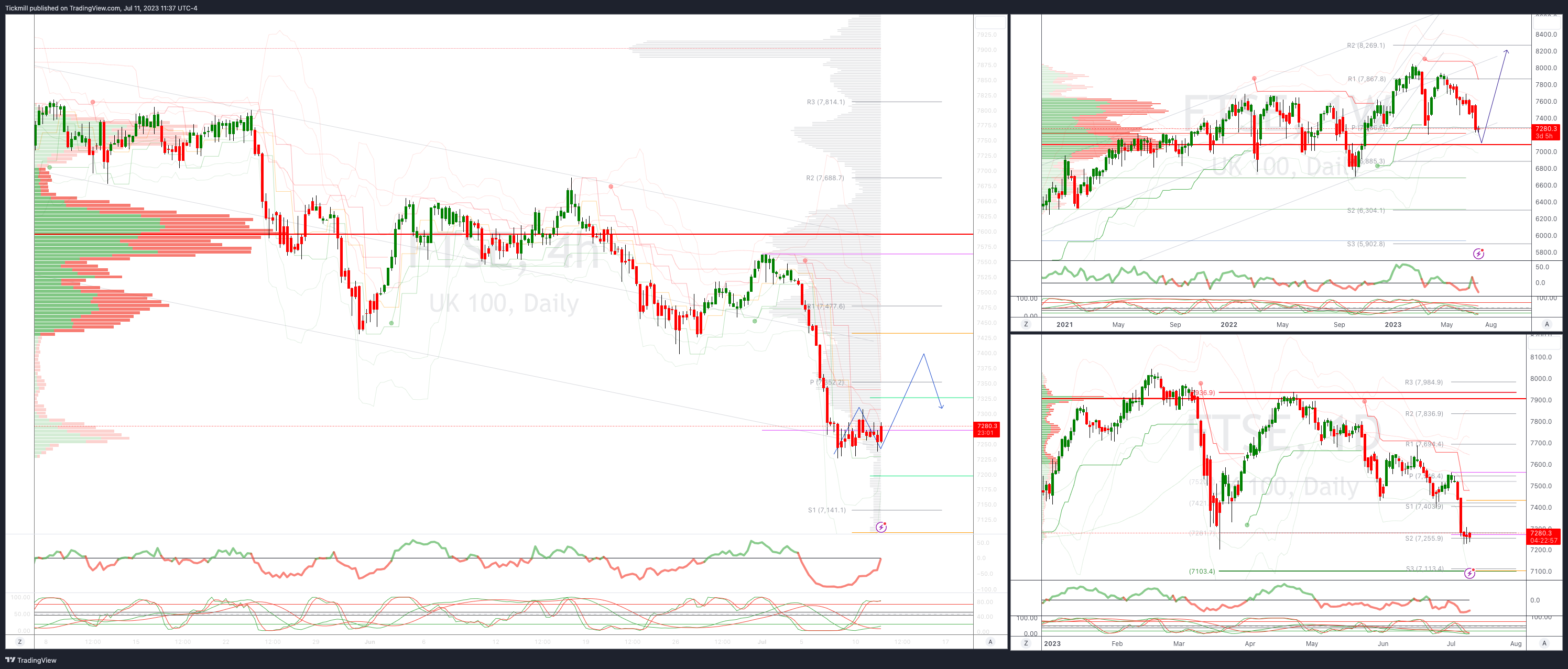

The FTSE is hugging the flatline into the close of Tuesday’s trading, the UK’s blue chip index continues to test pivotal support in the 7250 region. The export heavy index was weighed by a stronger Sterling today this was somewhat countered by another strong showing from the miners as metal prices remained well supported, as precious metals miners index was up over 1.2% with AnlgoAmerican leading the charge in the group gaining 1.78% on the day additional support for the sector came as the People's Bank of China (PBoC) announced that it is extending policies related to support for the real estate actor until the end of 2024. It is a real estate firm that sits at the of the index today Land Securities is up over 3% on the session after the commercial real estate firm maintained a positive outlook, citing strong operational momentum even in the face of ongoing economic uncertainty. On the negative side of the ledger shares of medical products firm Convatec are down 1.7% on the session and leaves them at the bottom spot on the index today closely followed by Rentokill who slid 1.67%.

On the fundamental front the bid behind Sterling was driven by the UK employment report for the March to May period indicating some changes in the employment landscape. The unemployment rate unexpectedly increased to 4.0% from the previous three-month period's rate of 3.8%. This rise was higher than market consensus, which anticipated an unchanged rate of 3.8%. Additionally, the number of unemployed individuals reached its highest level since 2021, surpassing the pre-pandemic level. Interestingly, despite the increase in the unemployment rate, the report also noted a rise of 102,000 in the number of employed individuals during the three months leading up to May. Therefore, the increase in unemployment can be attributed more to a shift of people from inactivity to actively participating in the employment market, either by working or actively seeking work, rather than companies laying off workers. The appreciation of the Sterling today can be attributed to the release of official figures confirming robust wage growth in the UK. According to the data, wages excluding bonuses increased by 7.3% in the three months leading up to May compared to the same period the previous year. This growth rate matches the highest recorded growth in wages. Such strong wage growth adds further pressure to the Bank of England's (BoE) concerns regarding inflation as markets are now pricing a potential 50bps move at the BoE’s next meeting

FTSE Intraday Bullish Above Bearish below 7400

Above 7550 opens 7660

Primary resistance is 7600

Primary objective 7193

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!