The FTSE Finish Line - August 01 - 2024

The FTSE Finish Line - August 01 - 2024

FTSE Rotating Around The Flatline As BoE Deliver First Rate Cut

The FTSE 100 in London opened higher on Thursday before giving back. gains to turn modestly red on the session -0.45%, initially supported by positive company reports and indications of a September interest rate cut by the U.S. Federal Reserve, as investors cheered the Bank of England's decision to reduce interest rates by 0.25%.

Energy stocks increased 1.3% on Wednesday, the day the industry had its best day since April 12 as oil prices continued to rise on the possibility of a larger conflict in the Middle East. Shell saw a 1.7% increase after reporting a $6.3 billion profit, beyond analysts' estimates, but a 19% quarterly decline. Rolls Royce's record high share price helped boost aerospace and defense equities by 3.5 percent. The aerospace engineer increased its outlook for operational profit and free cash flow following a solid first half. Conversely, with a 1.3% decline, travel and leisure companies led declines. Wizz Air's 14% decline to the bottom of the FTSE 250 occurred after the company cut its annual profit projection and revealed a 44% decline in its first-quarter revenue.

Melrose Industries, a UK aerospace supplier, has reduced its 2025 revenue forecast, leading to a 3.7% drop in its share price on the FTSE 100 index. The company now expects 2025 revenue to be 3.8 billion pounds, down from the previous forecast of 4 billion pounds. However, Melrose has maintained its outlook for the fiscal year 2024 and its 2025 profit targets. The company reported a 52.2% year-over-year increase in its half-year adjusted pre-tax profit, reaching 204 million pounds.

Next Plc's shares hit a record high after the UK clothing retailer raised its annual profit forecast. The stock rose as much as 8.6% to a record 9,858 pence, making it the second-biggest gainer on the FTSE 100 index. Next increased its full-year pre-tax profit forecast by 20 million pounds to 980 million pounds. The company reported a 3.2% growth in second-quarter full-price sales, beating market estimates of a 0.3% decline. Next maintained its forecast for full-price sales in the second half of the year. The stock has gained 21% so far this year.

UK's Smith+Nephew rises on surpassing H1 profit market expectations Shares in Smith+Nephew climb 9%, making it one of the top gainers on the FTSE 100 index. The British medical equipment maker reports H1 trading profit of $471 million, exceeding analysts' mean estimate of $462 million The company maintains its full-year outlook unchanged.The stock has risen 9% so far this year

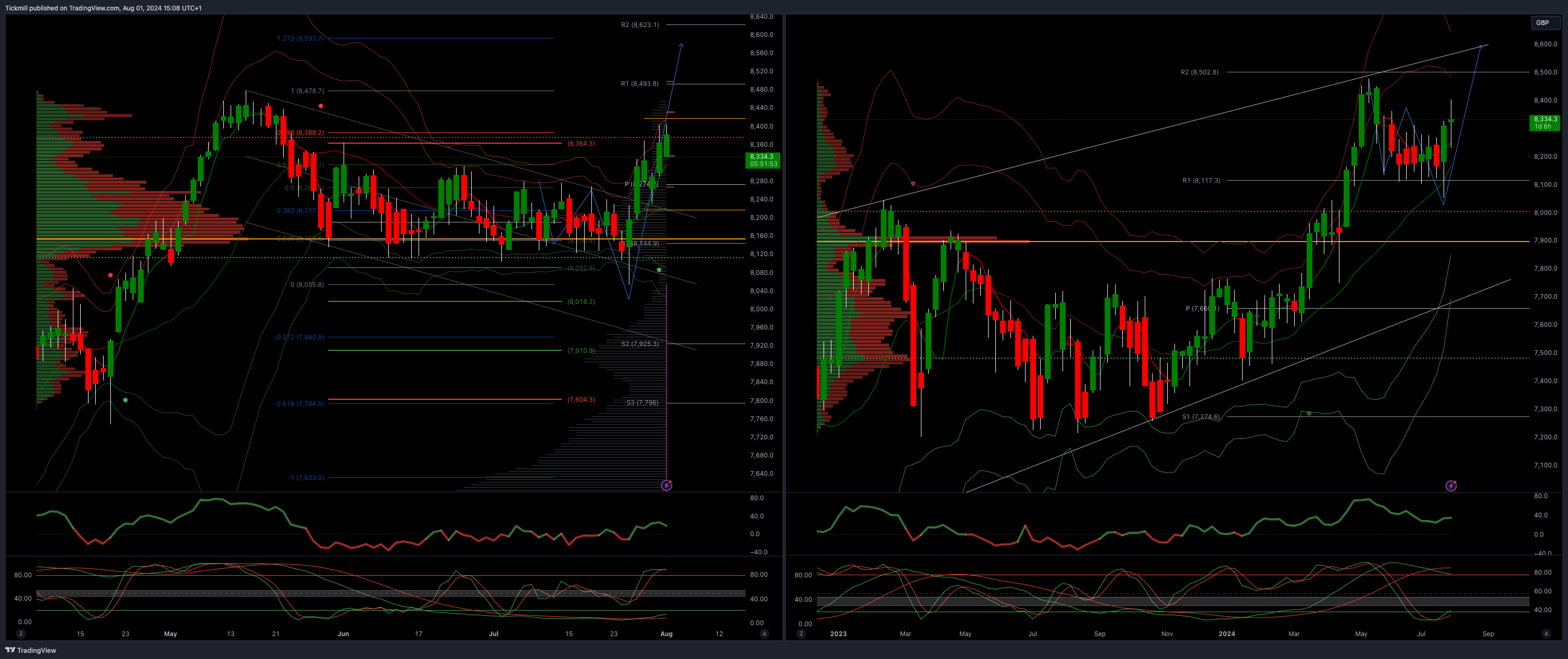

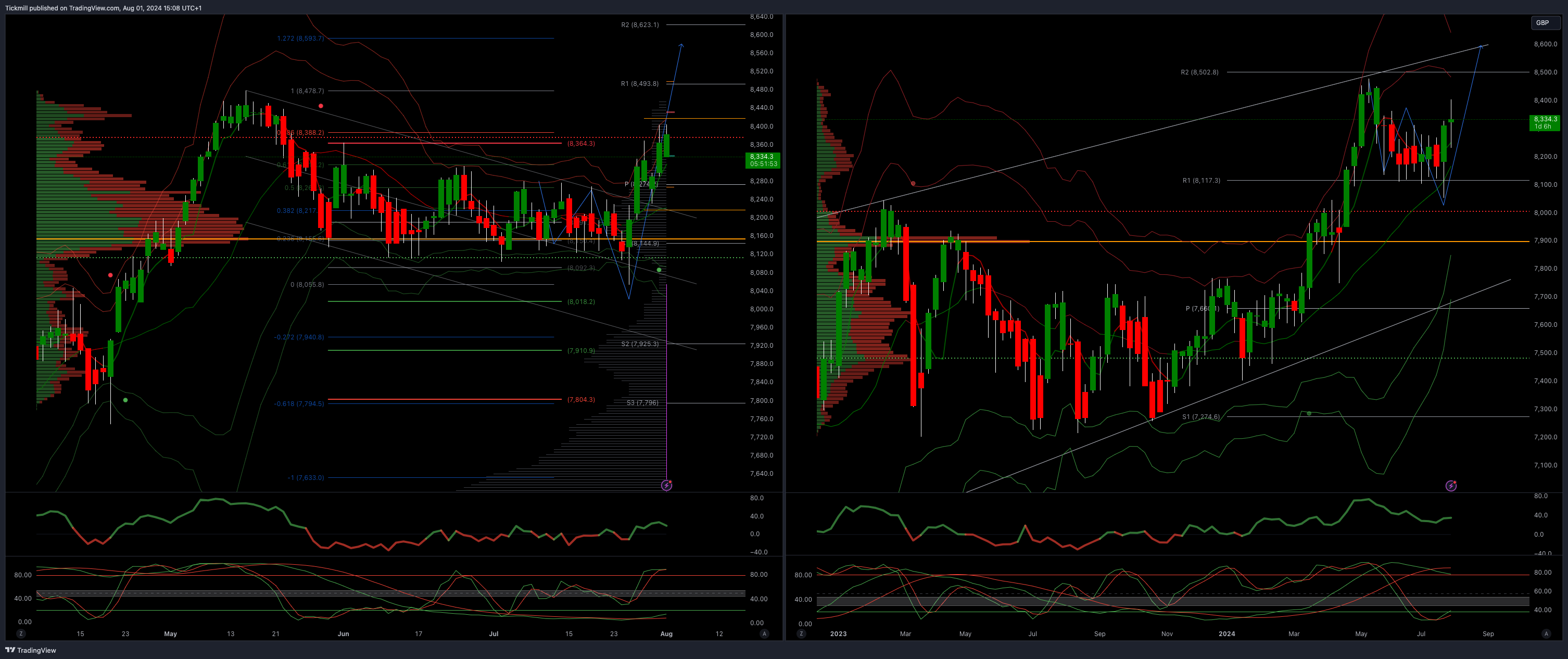

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Primary objective 8593

Daily VWAP Bullish

Weekly VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!