SP500 LDN TRADING UPDATE 14/7/25

SP500 LDN TRADING UPDATE 14/7/25

***QUOTING SEP CONTRACT FOR JUNE CONTRACT OR CASH US500 EQUIVALENT LEVELS SUBTRACT ~40 POINTS***

***WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN***

WEEKLY BULL BEAR ZONE 6220/30

WEEKLY RANGE RES 6384 SUP 6204

DAILY RANGE RES 6358 SUP 6241

DAILY VWAP BEARISH 6299

WEEKLY VWAP BULLISH 6026

DAILY BALANCE - 6246/6335

WEEKLY ONE TIME FRAMING UP - 6246

MONTHLY ONE TIME FRAMING UP - 5870

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

One-Time Framing Down (OTFD): This describes a market trend where each successive bar forms a lower high, indicating a pronounced and steady downward movement.

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES WEEKLY UPDATE

FICC and Equities | 11 July 2025 | 8:12 PM UTC

Market Overview:

This week, U.S. stocks closed relatively flat, with momentum factors remaining a key focus. The High Beta Momentum pair declined approximately 10% this month. The desk view suggests we are in the early stages of this episode due to:

1. A friendlier-than-expected risk backdrop, supported by a passed tax bill (boosting capex and consumer benefits), the July 9 tariff deadline being postponed, anticipated rate cuts, and contained long-term rates.

2. Expectations for deeper and earlier rate cuts than previously forecast, alleviating pressure on companies impacted by prolonged higher rates. Treasury issuance adjustments (July QRA) could also provide support.

Flows and Sector Dynamics:

Desk flows revealed Long-Only investors as net buyers (+$5 billion), while Hedge Funds remained flat. Sector skews were generally benign, except for strong demand in tech as AI headlines continued to drive aggressive buying. Next week’s implied S&P move through Friday (7/18) is 1.39%.

Upcoming Events:

Key macro data releases include CPI (Tuesday) and Retail Sales (Thursday), offering insights into the tariff impact on consumers. Q2 earnings kick off Tuesday, led by major banks (representing 10% of S&P market cap and 43% of financials market cap).

Hedge Fund Activity:

After eight consecutive weeks of net buying, Hedge Funds modestly net sold U.S. equities for the second week, with single-stock de-grossing activity observed for the first time in nearly five months. Financials faced unwinding risk for the second week, driven by long sales outpacing short covers. Conversely, Consumer Staples, the worst-performing sector this week, saw significant dip-buying, ranking in the 98th percentile for five-year notional net buying.

Leverage Metrics:

U.S. Fundamental Long/Short gross leverage fell 1.3 pts to 211.7% (96th percentile, three-year), while net leverage decreased 0.1 pts to 51.7% (42nd percentile, three-year).

---

Sector Highlights:

Financials:

Financials earnings begin next week, led by major banks on Thursday. While some 2Q weakness appears priced in, the bar remains high due to recent rallies and long positioning. Investors are focused on net interest income (NII) revisions and capital return timing/magnitude. TRV’s insurance report will be closely watched amidst concerns of a prolonged soft pricing cycle. Key names to monitor include BAC, AXP, and HBAN.

Consumer:

Q2 started strong but now feels more neutral. Staples trends remain soft, with mixed performance across restaurants, hotels, and general merchandise. Positive data points include DAL’s strong results and COST’s better-than-expected June trends. While consumer spending appears steady, it’s less robust than early Q2 hopes. The sector remains underinvested, with gross exposure at five-year lows in discretionary. Thematic trades include high vs. low income, lower rates (housing), and corporate travel linked to AI/jobs.

TMT (Technology, Media, Telecom):

Despite a muted headline performance (NDX -24 bps), underlying dynamics were highly active, with Quality, Crowding, Momentum, and Growth factors lagging sharply. Price action reflected reversion from hot AI/winner trades, macro digestion (tariff clarity), and easing financial conditions. Next week’s earnings spotlight includes ASML (order trends), TSM (FX/GMs vs. AI narrative), and NFLX (beat/raise expectations).

Energy:

- Natural Gas: Momentum in AI/data center themes has driven interest, but bearish sentiment is emerging around downside expectations for the 2026 Henry Hub curve (pricing above $4). A curve re-rate below $4 could pressure equities with higher free cash flow breakevens.

- Copper: Headlines around the 50% import tariff (vs. expected 25%) drove COMEX-exposed equities higher by 200-300 bps, though relative underperformance persisted. The market is pricing only a 25% chance of the tariff sticking. Key names include FCX, TECK, and IVN, with debates around rate-of-change equities vs. high-quality plays.

Industrials:

The sector gained 50 bps this week, outperforming broader markets (-20 bps) as cyclicals and shorted areas saw strong bids, particularly in housing and transports. DAL surprised with a Q3 guide above expectations, lifting airlines (+10%). BLD rose 10% after a roofing acquisition. Key earnings next week include FAST, UAL, GE, MMM, JBHT, CTAS,

Earnings Playbook

FICC and Equities | 11 July 2025 | 7:14 PM UTC

Earnings season kicks off this Tuesday with several major banks—JPM, WFC, C, BK, STT, and BLK—set to report. Banks have been a standout sector in the market, with key discussions likely to focus on NII outlooks, capital markets activity and pipelines, as well as capital return strategies. Our team has prepared an excellent financials preview that’s worth reviewing.

Key Takeaways:

- The expectations are modest, but we believe they’ll be met. Analysts forecast S&P 500 EPS year-over-year growth to slow to just 4% in Q2, down from 12% in Q1.

- At a broader level, attention will be on the effects of tariff policies on margins, sales, and investment spending. Current projections suggest that consumers are expected to bear the majority (70%) of the tariff cost burden. However, if this doesn’t hold, it could exert additional pressure on corporate margins.

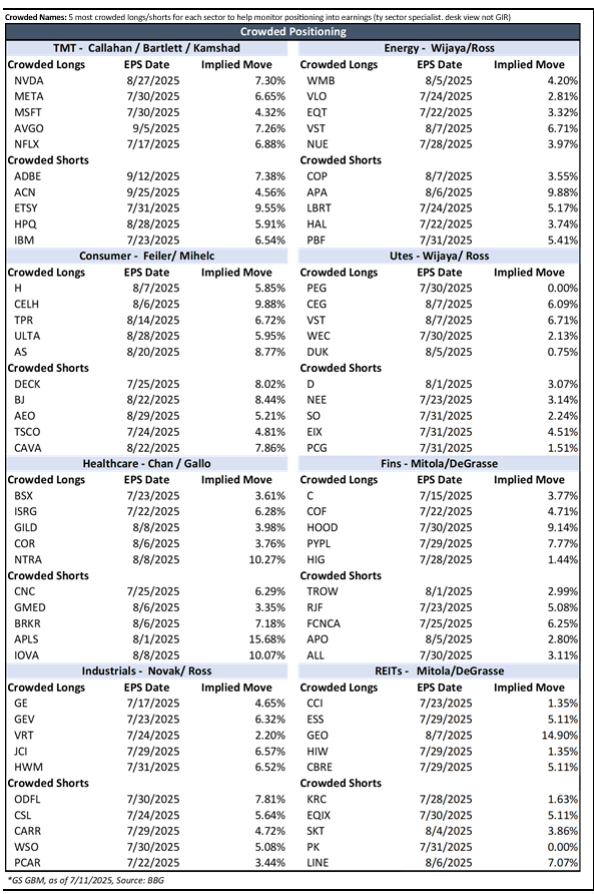

Crowded Positions:

Here are the top five most crowded long and short positions for each sector to help track market positioning ahead of earnings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!