SP500 LDN TRADING UPDATE 07/05/25

SP500 LDN TRADING UPDATE 07/05/25

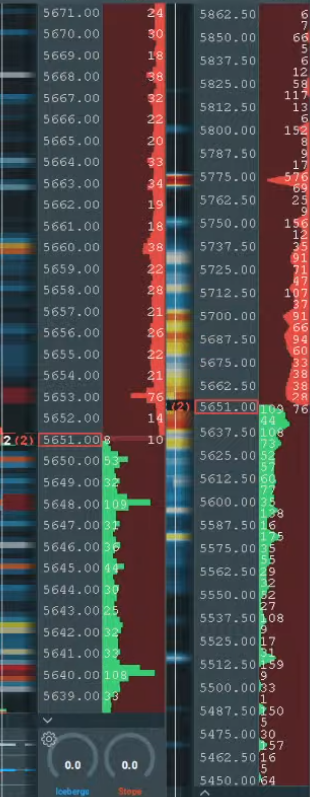

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5630/40

WEEKLY RANGE RES 5840 SUP 5580

DAILY BULL BEAR ZONE 5610/00

DAILY RANGE RES 5675 SUP 5550

2 SIGMA RES 5911 SUP 5339

5339 - 5608 GAP LEVELS

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 25 POINTS)

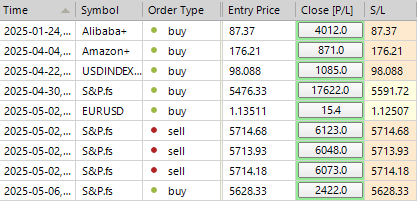

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON ACCEPTANCE ABOVE 5693 TARGET 5721>5739>WEEKLY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: LACKLUSTER SESSION

FICC and Equities | 6 May 2025 | 8:28 PM UTC

Market Performance:

- S&P 500: -77bps, closing at 5,606 with MOC $2.2B to BUY (11 consecutive days).

- NASDAQ 100 (NDX): -88bps, closing at 19,791.

- Russell 2000 (R2K): -110bps, closing at 1,989.

- Dow Jones (DJIA): -95bps, closing at 40,829.

Volume & Volatility:

- Total shares traded: 14.3B across U.S. equity exchanges, below the YTD daily average of 16.4B (-23% vs. 20-day moving average).

- VIX: +470bps, closing at 24.74.

Commodities & Currencies:

- Crude Oil: +350bps, closing at $59.12.

- Gold: +328bps, closing at $3,431.

- U.S. 10-Year Yield: -3bps, now at 4.30%.

- DXY (Dollar Index): -62bps, now at 99.21.

- Bitcoin: +81bps, trading at $95,000.

Market Sentiment:

A muted session for U.S. equities as investors paused following last week’s rally. Sentiment was dampened by disappointing microeconomic updates:

- Companies pulling guidance (e.g., Ford, Mattel, Lear).

- Concerns over trade tariffs (e.g., Clorox, Royal Philips, Vestas).

- Strong but below-expectation results (e.g., Palantir, Genius Sports, BellRing Brands).

In contrast, Celsius, Aramark, and Marriott outperformed, benefiting from low expectations.

Biotech Sector:

Biotech fell sharply (-7%) after Vinay Prasad was appointed as the new director of the FDA’s CBER, replacing Peter Marks. The market reacted negatively to Prasad’s critical stance on accelerated drug approvals and vaccines. Gene therapy stocks, particularly those reliant on fast-track pathways, were hit hard (e.g., Sarepta Therapeutics -27%).

Institutional Activity:

- Institutional trading remained subdued, with overall floor activity rated a 4/10.

- LOs were slight net buyers, focused on macro products.

- Hedge funds were net sellers (-$700M), driven by short supply in biotech.

Post-Bell Earnings Movers:

- Arista Networks (ANET): +3% (beat and raised 2Q guidance).

- AMD: +6% (now over 30% above YTD lows).

- Lumentum (LITE): +7%.

- Cirrus Logic (CRUS): +7%.

Macro Outlook:

- FOMC meeting tomorrow: Goldman Sachs expects three consecutive 25bps rate cuts in July, September, and October. Chair Powell is anticipated to reiterate a cautious stance due to tariff-related risks.

Derivatives Market:

- Volatility was bid, though slightly underperformed spot moves. Liquidity improved due to dealer gamma positioning, contributing to stable price action.

- Ahead of the PBOC press conference, notable demand for upside in China tech (e.g., BABA, KWEB, FXI) via calls and call spreads out to June expiry.

Key Focus:

The FOMC meeting tomorrow will dominate market attention, with the SPX implied move currently at just 1.1% for the day.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!