Market Spotlight: US Bond Yields Creeping Higher

Bond Yields Moving Back Up Again

US bond yields have been on the decline recently. Following the concerning 70% rally we saw over most of Q3, the US 1O-yr yield has since corrected by around 15%. A large part of this has been the shift in market perspective recently regarding Fed tightening expectations. Traders have become increasingly eager to call a top in the Fed’s tightening program. Last week’s softer-than-projected October US CPI release was taken as a clear sign that the Fed will opt for a smaller rate hike in December, marking the start of the Fed Pivot.

Fed Pivot Not Done Deal

However, over the last couple of days, bond yields have started to creep higher again. With the latest US retail sales data coming in above forecasts, the doves’ argument that Fed rate hikes are harming the economy has lost some impact. Additionally, we’ve heard some hawkish comments from Fed members into the end of the week which have also caused some concern. Fed’s Bullard was the most hawkish this week, calling for US rates to peak around 5% - 7% in order to drive inflation back to target, well above the Fed’s own current peak-rate projections.

Technical Views

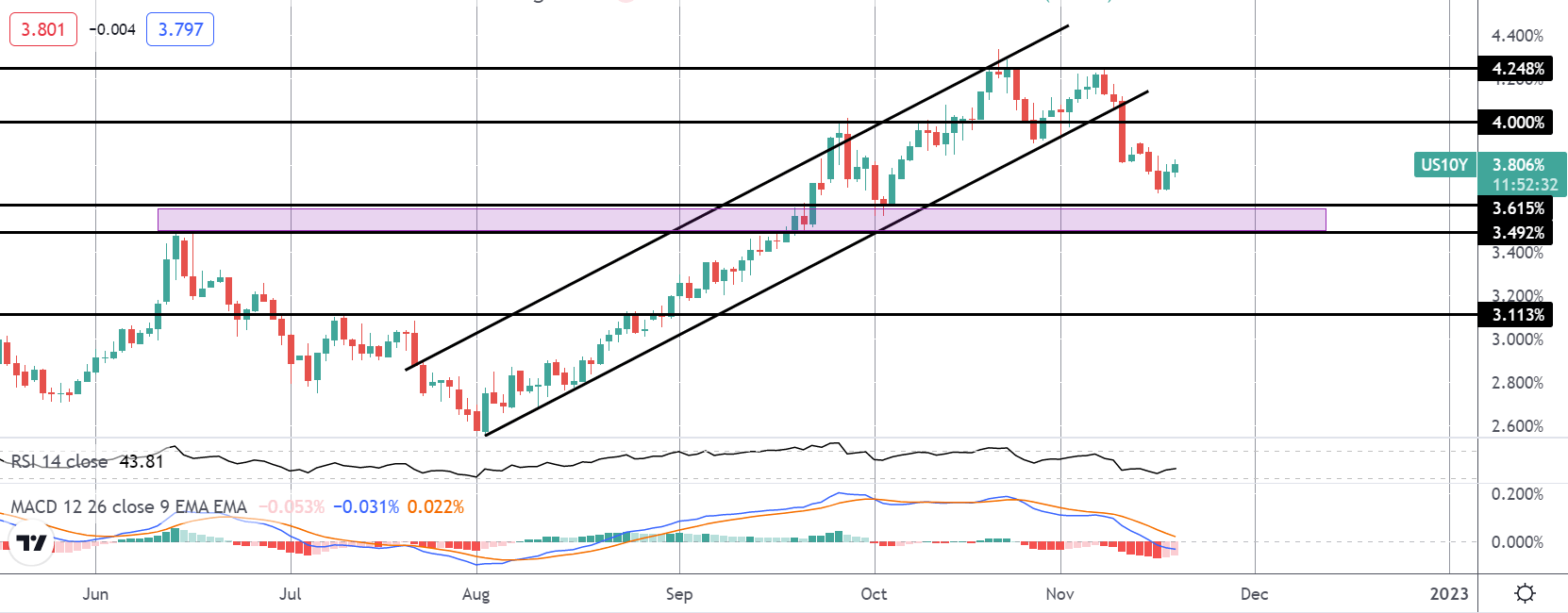

US 10-yr Yield

The failure at the 4.248 level has seen the market breaking down below the 4.000 level, confirming a double top-lower high. With momentum studies having turned bearish, the focus is on test of the next big support zone around 3.615 – 3.492. While price holds above here, there is risk of a further push higher in the medium view. If bulls can beak back above 4.000, bears might well be in trouble.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.