Market Spotlight: Applied Materials Bullish View

AM Shares Rallying

Chipmaker Applied Materials has been one of the key stocks to benefit from the surge in demand for AI this year. The company recently posted bumper Q4 earnings with both EPS and revenues coming in above target and cited the growth in demand from companies looking to scale up their AI business as a key driver of success. Looking ahead, with AI set to continue to grow in terms of a spending focus for tech business, AM looks poised for further upside in the near-term.

China Demand Boost

The rebound in business activity in China on the back of the borders reopening is also a firmly encouraging sign. With plenty of demand set to come from China as the economic recovery continues there, chipmakers such as AM look set to benefit greatly from increased demand from the Chinese semiconductor market.

New System Unveiled

Furthermore, AM looks to set enjoy a surge in demand on the back of announcing a new chipmaking system which lowers the cost of etching transistors into semiconductors. This allows the company to make high performing transistors at a lower cost for makers of semiconductors, giving it a clear competitive advantage over its rivals.

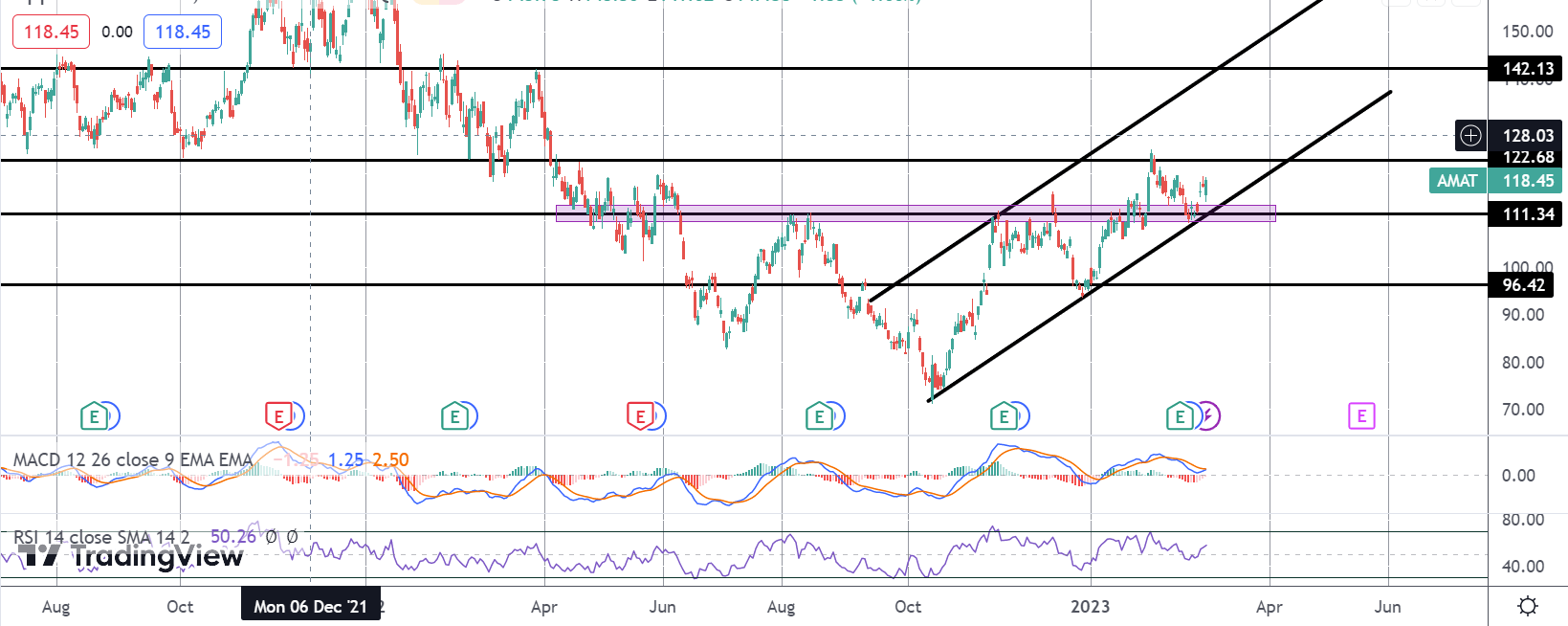

Technical Views

Applied Materials

The rally in AM stock has stalled for now into a test of the 122.68 level. Price has subsequently corrected and is now testing the 111.34 level and bull channel lows. While price holds here, the focus remains on a further push higher within the channel targeting 142.13 longer term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.