Israel Ceasefire Talk Halts Crude Momentum

Oil Rally Pauses for Now

The rally in oil prices has stalled into the middle of the week as the prospect of an Israel – Hamas ceasefire moves into fresh focus. Crude futures have been on a strong rally so far this year with the market advancing pushing higher by more than 10% from the January open. The move has been linked to renewed optimism over China on the back of recent stimulus efforts, expectations of further action, and recent better data. Similarly, continued economic strength in the US has helped further underpin bullish sentiment.

Ceasefire Talk

News this week that Israel and Hamas are reportedly close to reaching a ceasefire agreement has dented bullish momentum for now, however. Uncertainty and geopolitical risks linked to the conflict in the Middle East has been a key upside driver of crude price action recently. Given the supply and distribution risks linked to violence in the region, the prospect of a ceasefire reduced these risks and therefore is ultimately bearish for crude.

USD On Watch

Alongside the downside pressure form ceasefire talk, crude is also vulnerable into US inflation today. If a fresh uptick is confirmed, this should see traders pushing Fed rate-cut expectations further out, leading to a renewed rally in USD which could see oil coming under pressure through the back end of the week.

Technical Views

Crude

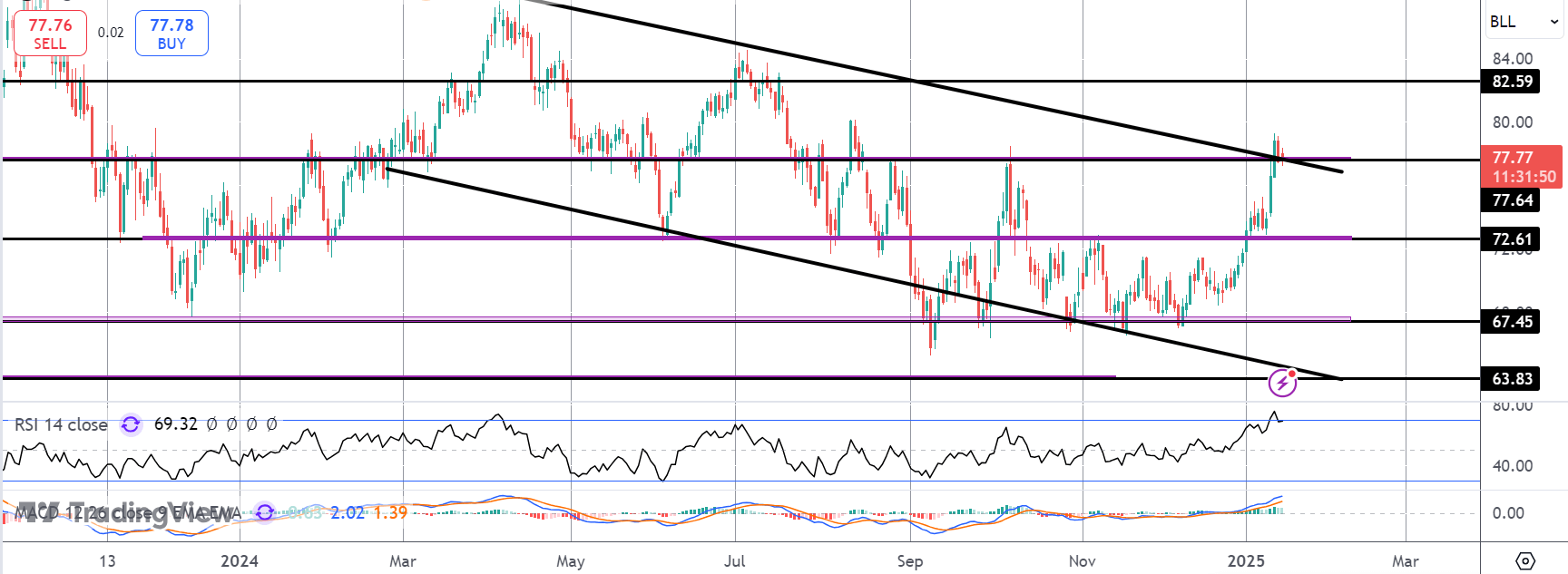

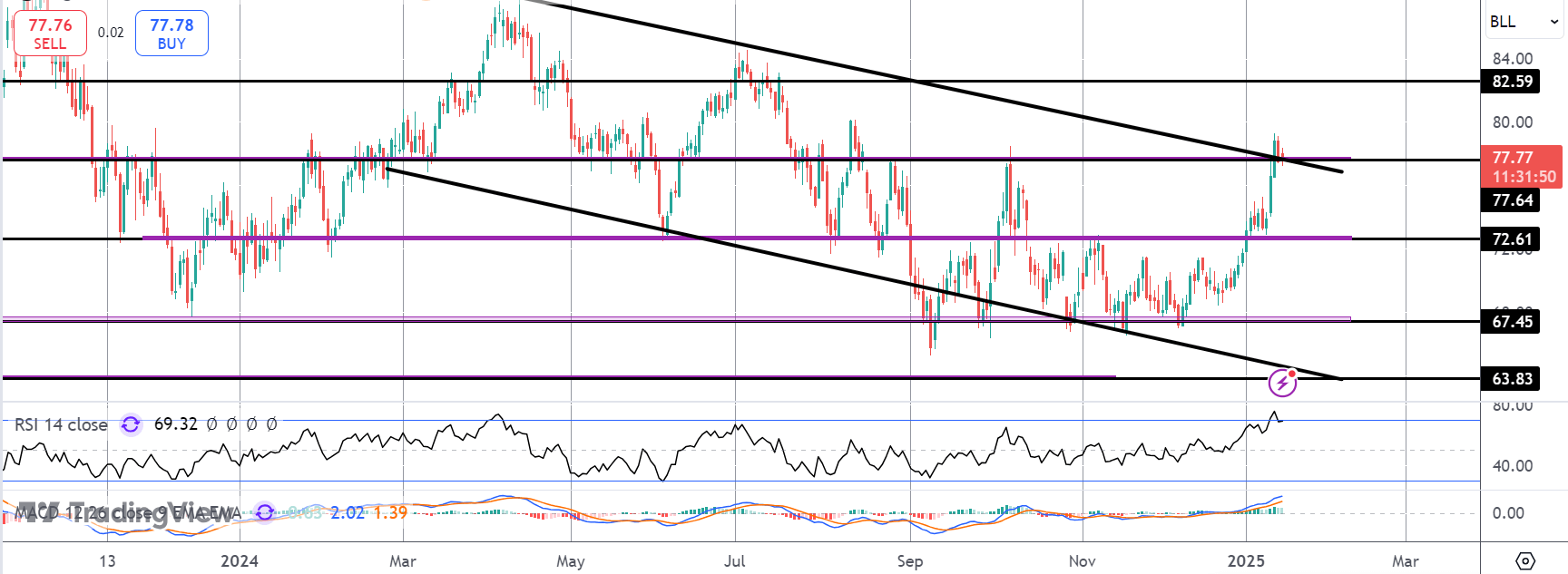

The rally in crude has seen the market breaking above the bear channel from 2024 highs and above the 77.64 resistance level. While price holds atop this level, look for a continuation higher, in line with bullish momentum studies readings, towards 82.59 next. Back below the level, 72.61 will be next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.