Institutional Insights: JPMorgan - US Equity Derivatives Strategy

US Equity Derivatives Strategy

Option expectations and trades into Q2 earnings, event risk pricing, systematic positioning

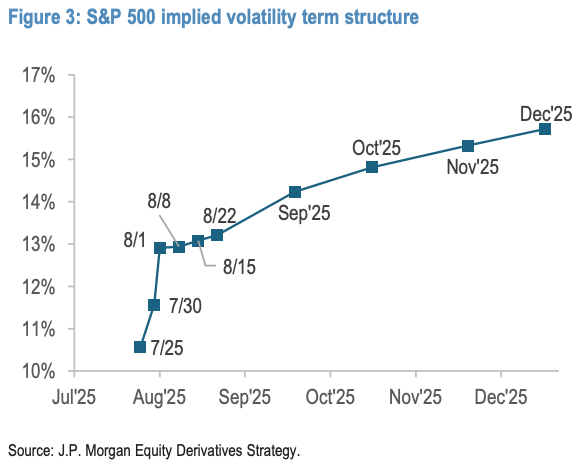

Volatility targeting portfolios are gradually re-leveraging, and their buying flows are expected to persist in the coming weeks unless there’s a resurgence of volatility. Concurrently, CTAs remain broadly long on global equities, though flow risks are negatively skewed. However, US large caps have a healthy downside cushion before key momentum signals turn negative, which could trigger CTA selling.

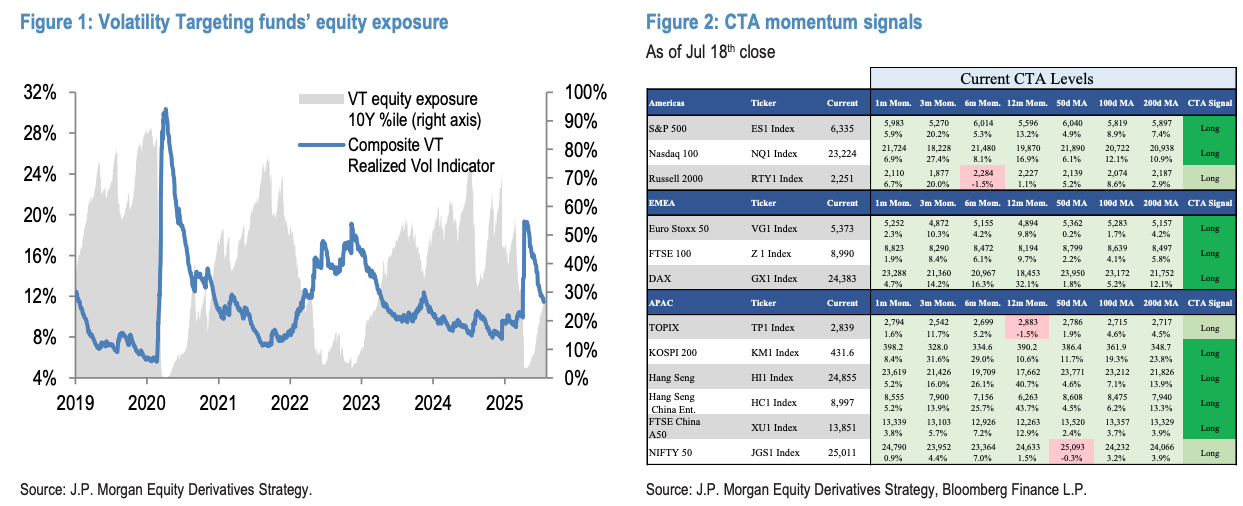

S&P 500 options currently reflect limited event risk premiums for key upcoming events, including the July 30th FOMC meeting, the August 1st tariff deadline, the NFP release, and the peak of Q2 earnings reporting that week. We recommend taking a long position in SPX gamma ahead of these events.

Consensus estimates project S&P 500 Q2 EPS growth of approximately 3.5% year-over-year, marking a notable deceleration from the prior quarter. Despite robust economic growth, a weaker USD, and lowered analyst expectations, companies face a low bar for Q2 earnings, which should lead to healthy beats on average. However, stock prices might not change much unless these better-than-expected earnings come with stronger predictions for the second half of the year, due to economic challenges like tariff risks and expected slow growth later in the year, along with recent big cuts to earnings forecasts for that period.

The options market anticipates moderately higher earnings volatility compared to recent quarters. This quarter’s average implied moves rank as the second-highest heading into earnings over the past two years but are notably lower than last quarter. We identify attractive opportunities to take long or short gamma positions into earnings.

Ahead of earnings, we suggest the following strategies:

- Buy put spreads and sell calls on tariff-sensitive stocks that have rallied significantly since Liberation Day, considering market complacency ahead of the August 1 deadline.

- Buy worst-of-calls on top internet stocks into earnings to capitalise on their decorrelation.

- Buy put spreads on ITB due to challenging demand trends, negative earnings season expectations, and tariff risks.

- Buy GOOGL call spreads to leverage strong earnings potential and the prospect of an AI-driven inflection point.

- Buy LLY calls in anticipation of robust earnings and two major catalysts with favorable risk/reward dynamics.

- Buy FCX call spreads based on strong fundamentals heading into earnings and the continued widening of the LME/COMEX spread.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!