Institutional Insights: Goldman Sachs, What can go wrong for risk after a 50bps Fed cut?

Institutional Insights: Goldman Sachs, What can go wrong for risk after a 50bps Fed cut?

The short answer is, in the short term, probably not a lot can go wrong for risk on the Fed starting with a 50bps cut this Wednesday.

However, given how much is priced in over the next 12-18 months, the market will be looking for guidance of the Fed’s pace and scope of easing in 2025 before deciding whether to add to reduce the trades that worked so far in September.

Sep MTD key asset performance: Gold, US long end and JPY outperforming vs losses in NKY, energy and SX5E is a regime typical of US and global growth weakness leading to the market pricing monetary easing.

After a lot of confusion due to the uncertainty of whether the current Fed is an active or reactive central bank, the market is settling for the active view, pricing 71% of 50bps cut into the Sep FOMC meeting. Risk has rallied and based on our risk martingale index, risky assets can rally further for another 5-10 sessions. We would not rush to get bearish on a 50, but it seems that for fund managers and risk managers here the right question to ask is, what can go wrong for risk after a 50bps Fed cut? Here are a few suggestions:

The Fed starting big but guiding a slower pace than priced by the market

• A disappointment to the perception that the Fed could be moving slower than the 1y1y nominals suggest, without improvement in economic surprises, isn’t hard to envisage. Despite the most likely 50bps initial cut, with US 1y1y OIS at 2.80, there is plenty of room for error in delivering the pace and scope of adjustment that has been key to some additional FCI easing the past couple of weeks.

• If the Fed is perceived as moving slower, FCI should re-tighten, oil should head lower again and market prices for inflation should head south, potentially putting upward pressure on real rates and strengthening the dollar.

• Thus, an initial 50 should not be seen as greenlight to sell volatility / go long carry because in this macro regime the risk of data or policy surprises is high.

• This can change if the implied and delivered easing as well as looser fiscal in July and August start having traction on economic data and data surprise indices start improving. If the economy starts coming back MXNJPY longs should come back in play.

• What we would be looking for? In the June economic projections, the mid-point of the 2025 policy rate central tendency was revised up to 4.15 (3.9-4.4) vs 3.75 (3.4-4.1) in March. We would be looking for a shift back to March levels or below to infer a dovish outcome. Weakness in China and Europe getting more visible and with higher impact on commodity markets

• The latest money supply and PPI data from China are making us worry that a new leg of a deflationary bust is starting.

• We are concerned that in 2025 credit issues can start spreading from property to broader manufacturing and services and that weak land revenues are limiting the scope of local government support for the economy and state owned enterprises.

• With US and Europe slowing down, the two large markets which have supported directly or indirectly Chinese export revenues will be losing steam at a time where the economy needs them most.

• Adding to still cheap USDCNH topside and EURUSD 1y straddles remain the main macro hedges for this scenario.

Refresh on our views in rates & FX

Rates Macro RV ranking and US 10y model

• G10 – SEK has made a big move to the receive side and we like 2y1y there which now carries positively. NZD, EUR and GBP are next in line. While USD is on the pay side, we refer for US direction from our 10y model which is still for modest downside in yields into October. CAD is very tight to US both in terminal and duration spreads and new receivers at these levels would be at risk of slower Fed or bounce in data. For duration hedges we prefer paying 5y5y US OIS rather than shorting TY1 or US1 as the cash risk premium is significant.

• EM – ZAR, CZK, HUF and COP remain the top ranks to receive. In ZAR we prefer moving up the curve as the short end is priced very tight to US. CZK and HUF spreads to EUR remain attractive relative to the historical distribution.

• US 10y model. Our 10y model implies that US 10s have run a bit ahead of the trend in September and there could be a risk of some correction but the model estimate for October after the first week of data releases is looking for a modest extension of the trend in lower 10y yields at the start of Q4.

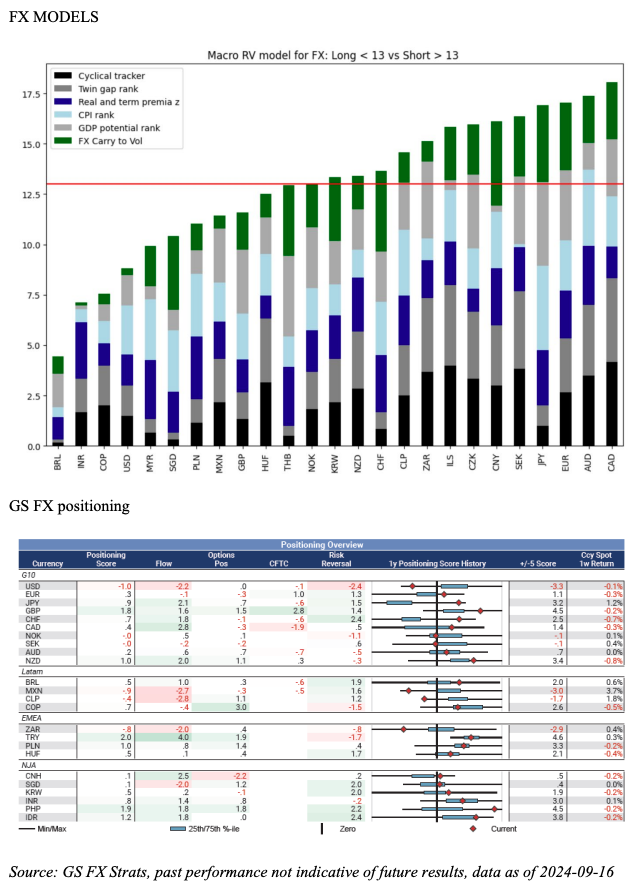

The dollar and FX Macro RV ranking

• The dollar is in a very close correlation with US 1y1y real rates but still lagging them and a genuinely dovish Fed and/or improving VP Harris lead in the battleground states could lead to 2-3% further weakness in the near term.

• While JPY remains the main long in this regime, any indication of the global cycle (ex US) regaining some traction would benefit EM (BRL and INR, two of the global growth leads, rank best on our macro RV model, while CAD and AUD have moved to top funders). An outperformance of the Euro and the European complex is not our central case at this point due weakening domestic cycle and relatively high exposure to China.

• After 150bps move in 1y1y real to +45bps (now sub R* HLW estimates of +70bps) there is some room for consolidation which would lead to dollar correction, but for the time being we do not project a more sustained rebound and we think that the lower dollar trend has more to run.

• We are not in the camp of big multi-year dollar weakness, and we would continue to play dollar shorts tactically on 1 to 3m horizon, mostly because we do not think that the outperformance of thekey US assets held by non-residents: technology / growth sectors and US credit is about to end soon,especially not if the Fed goes relatively quickly back to neutral

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!