Institutional Insights: Goldman Sachs -Gold and Oil in Long-Run Portfolios

The Strategic Case for Gold and Oil in Long-Run Portfolios

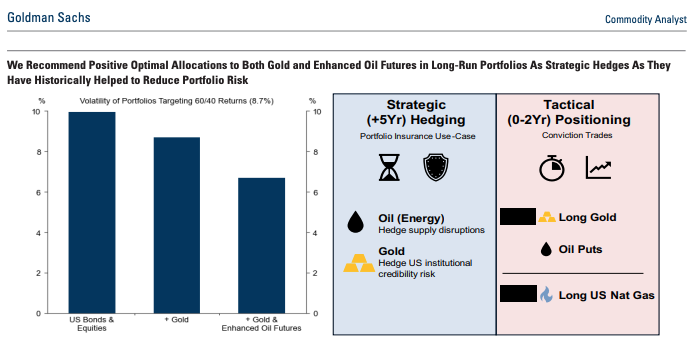

Following the recent failure of US bonds to protect against equity downside and the rapid rise in US borrowing costs, investors seek protection for equity-bond portfolios. We reach two conclusions on the strategic case for gold and oil in portfolios with a long horizon, that we define as 5+ years.

First, history suggests that positive long-run allocations to gold and enhanced oil futures are optimal for investors seeking to minimize risk or tail losses for a given return. The key reason is that gold and oil are critical hedges against the two major inflation shocks that can hit equity-bond portfolio returns. Gold hedges against losses in central bank and fiscal credibility, while oil often protects against negative supply shocks. In fact, during any 12-month period when real returns were negative for both stocks and bonds, either oil or gold have delivered positive real returns.

Second, we recommend a higher-than-usual allocation to gold and a lower-than-usual allocation to oil in long-term portfolios. We recommend overweight gold because of 1) the high risk of shocks to US institutional credibility (e.g., fiscal expansion, pressure on the Fed), and 2) the central bank demand boost to gold. We recommend underweight oil because of high spare capacity, which reduces the risk of 2025-2026 shortages. That said, extreme energy disruption shocks (as in 2022) are difficult to predict, and a sharp slowdown in non-OPEC supply growth from 2028 raises the risk of oil inflation shocks down the road. Therefore, for strategic (5+ year) hedging portfolios, we advise an underweight but positive allocation to oil, balancing expected oversupply in 2025-2026 with potential long-term risks. Conversely, for tactical (0-2 year) portfolios, we recommend using oil puts (or put spreads) to hedge against ongoing recession risks and to benefit from increasing oil supply

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!