Gold Softens As Trump Pauses on Iran

Shifting Safe-Haven Impact

Gold prices have turned lower across the week, despite rising geopolitical uncertainty which typically supports the metal via increased safe-haven demand. The ongoing conflict between Israel and Iran, and the growing prospect of US involvement, continues to be the driving force for markets though, in change to recent dynamics, USD has emerged as the preferred safe haven play. Across the year to date, gold had seen steadily higher prices fuelled by rising safe-haven interest and a weaker US Dollar but with the USD sell off stalling for now, gold is struggling to find fresh bullish momentum.

Trump Pauses on Iran

Gold prices are also weakening on Friday in response to news that Trump has not yet decided on an Iran strike, signalling that he will wait another two weeks before deciding. The news has fuelled some relief in markets with equity futures rallying off the lows today as traders sense that perhaps Trump will refrain from US action. The hope is that Iran will choose to negotiate, or call a ceasefire, in this time. If seen, gold prices should see a deeper correction lower amidst a firmer relief rally in risk assets. However, if the conflict doesn’t abate over this two-week window, and US action looks to be forthcoming, gold prices could see fresh safe-haven demand kicking in again as traders panic.

Technical Views

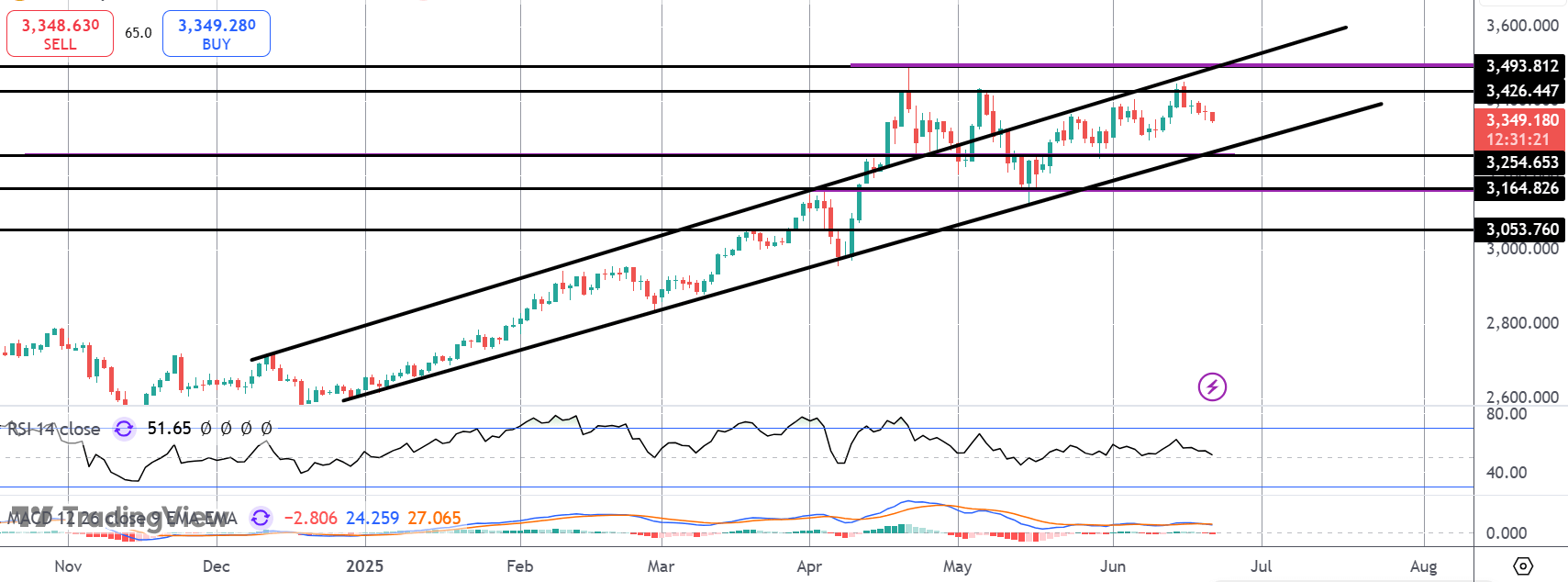

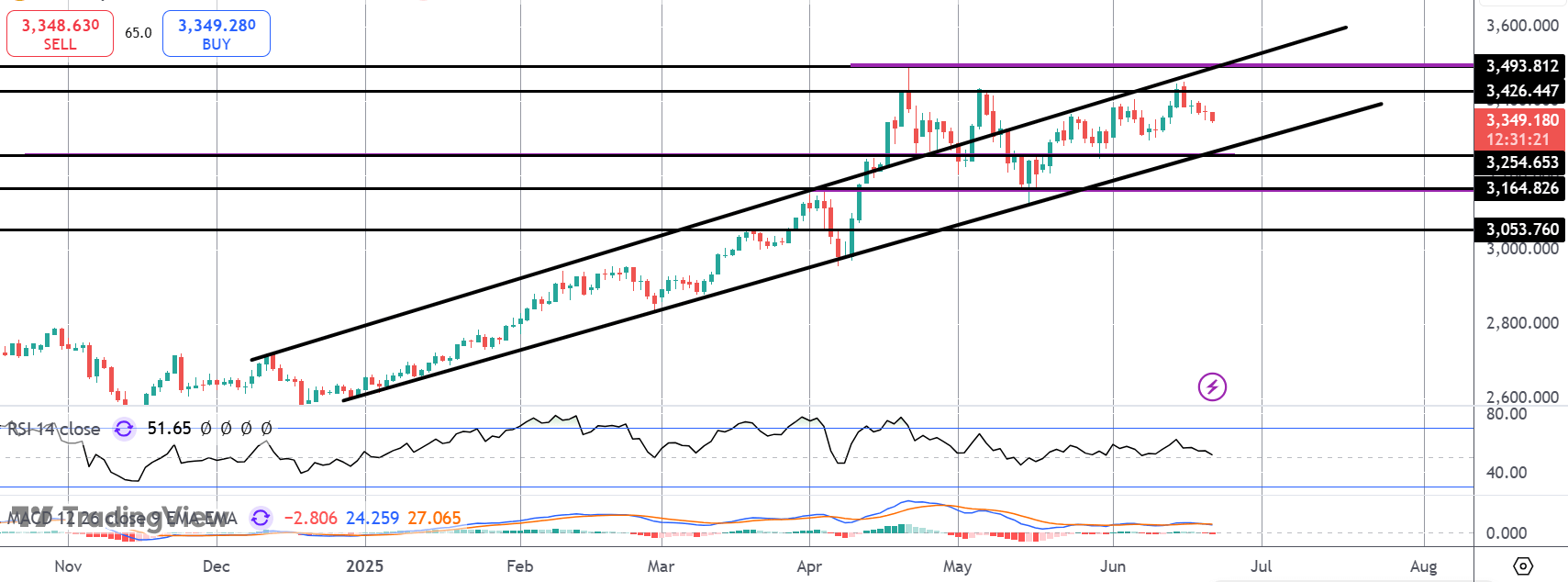

Gold

The rally in gold has stalled for now into the 3,246.44 level with price now turning back down towards the bull channel lows. 3,254.65 (and channel lows) will now be the key support zone to watch with bulls needing to defend to maintain the upside bias.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.