Euro Rises as ECB Takes Lead in Tightening Race, US Consumer Confidence Improves

Market volatility continues to decrease as the S&P 500 VIX (also known as the "fear index") dropped to 21 points, the lowest level since March 9th. It's worth noting that this was around the time when the first news related to SVB Financial started to emerge:

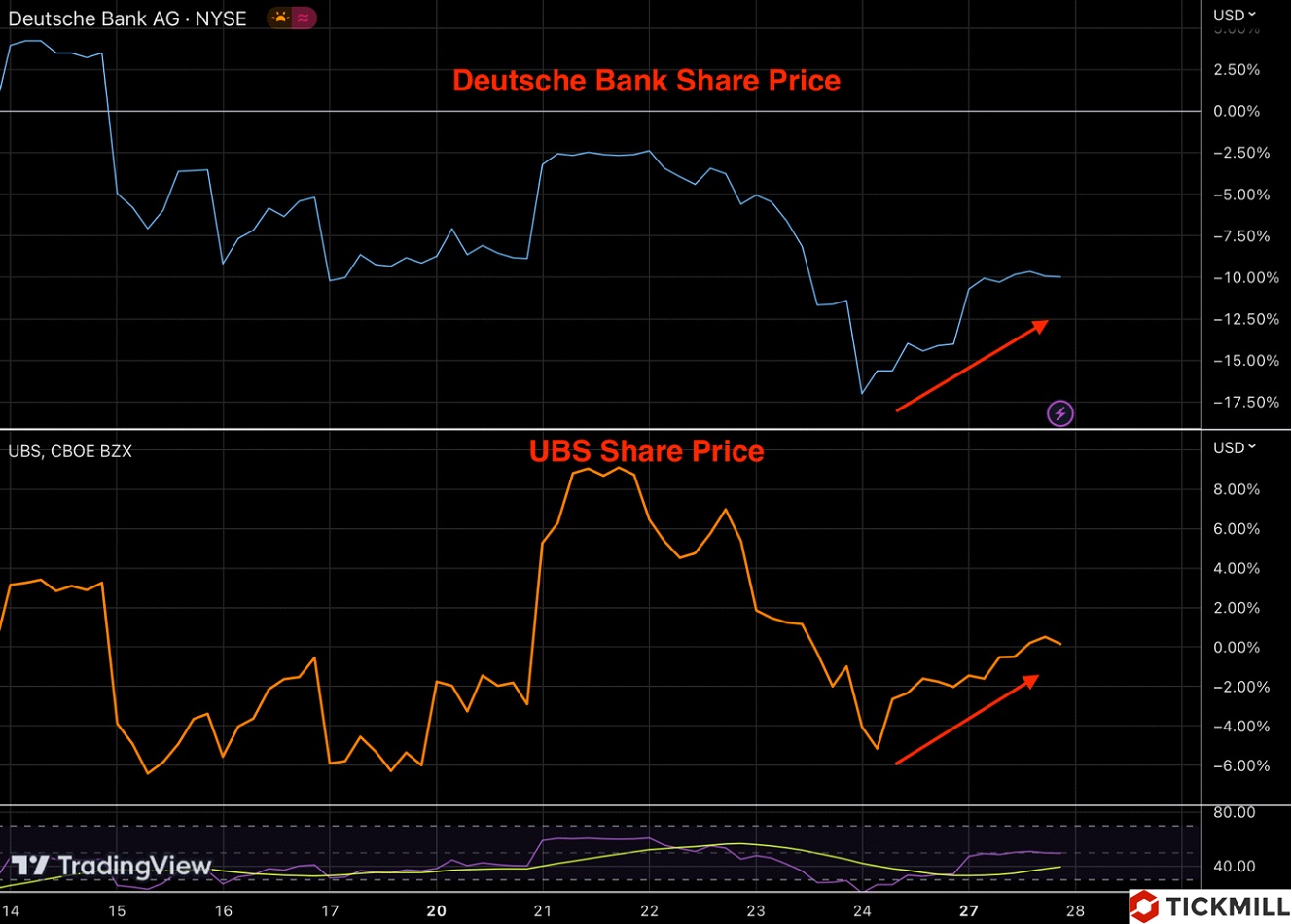

The two key culprits of recent instability in European financial markets, Deutsche Bank and UBS, are being seen as less of a concern as both banks' stocks have risen in the past few days:

This indicates investor optimism towards the companies' financial positions and the aftermath of Credit Suisse's acquisition.

Against this backdrop, EURUSD has climbed over 1.08 (as mentioned yesterday) due to a reassessment of risks surrounding a full-scale banking crisis and liquidity shortage in the interbank market, with the divergence in ECB and Fed policies coming to the forefront. The rhetoric of ECB officials is becoming increasingly saturated with comments stating that inflation risks have risen and more decisive action is needed. The head of the Estonian central bank, Müller, has joined the cohort of officials taking this position. He stated that inflation drivers are currently very active and concerning, and that there is room for interest rate hikes. It's rare to see such unambiguous comments from officials at major central banks, and this certainly shifts the risks towards ECB policy tightening in favor of more aggressive and prolonged measures. On this backdrop, Fed officials' statements appear more cautious.

ECB's leadership in the "tightening race" allows for continued EURUSD rally in the near future within an upward channel presented below. The minimum goal is the March high of 1.091, and then after a rebound, a retest of the 1.10 area can be expected, where strong resistance emerged in early February on a sharp improvement in the US macroeconomic backdrop.

Risks regarding Core PCE for March, the Fed's key inflation indicator, have shifted downwards, and risky assets account for this additional rise, while the dollar hits new local lows. Weak Core PCE will significantly facilitate upward movement for EURUSD buyers.

The Conference Board's Consumer Confidence Index for March exceeded expectations, coming in at 104.2 points (forecast was 101 points). The monthly change in home prices in the US market was 0.2%, while the Case-Shiller price index rose 2.5% in annual terms. Overall, the data suggests further (albeit modest) optimism on the US stock market in the short term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.