Dollar Soars On Fresh US Inflation Spike

US inflation Jumps

The US Dollar is rebounding through the middle of the week after yesterday’s hotter-than-forecast inflation data. Annualised headline CPI printed 2.7% in June, up from 2.4% prior and above the 2.6% the market was looking for. Similarly, both core and headline monthly readings were seen topping forecasts also. In all, the data was firmly hawkish with traders sensing that the uptick in inflation reflects the eventual impact of Trump’s trade tariffs. Given that reciprocal tariffs are set to rise again next month there is now a great deal of uncertainty over US inflation and the potential for price pressures to keep rising. If this is seen, Fed rate cuts later in the year look highly questionable unless we see greater weakness in the labour market.

Tariff Impact

USD bulls had been calling for higher inflation over much of the year so far as a result of the US trade war. However, the anticipated upside impact on inflation failed to materialise with Trump himself arguing that tariffs had no impact on inflation. The general view, however, was that there would be some lag before the inflationary impact was seen. As such, traders will now be waiting to see if this latest reading was a blip or the start of a new trend higher in inflation. If the latter looks likely, easing bets are likely to be scaled back quickly, paving the way for a broader rally in USD.

Technical Views

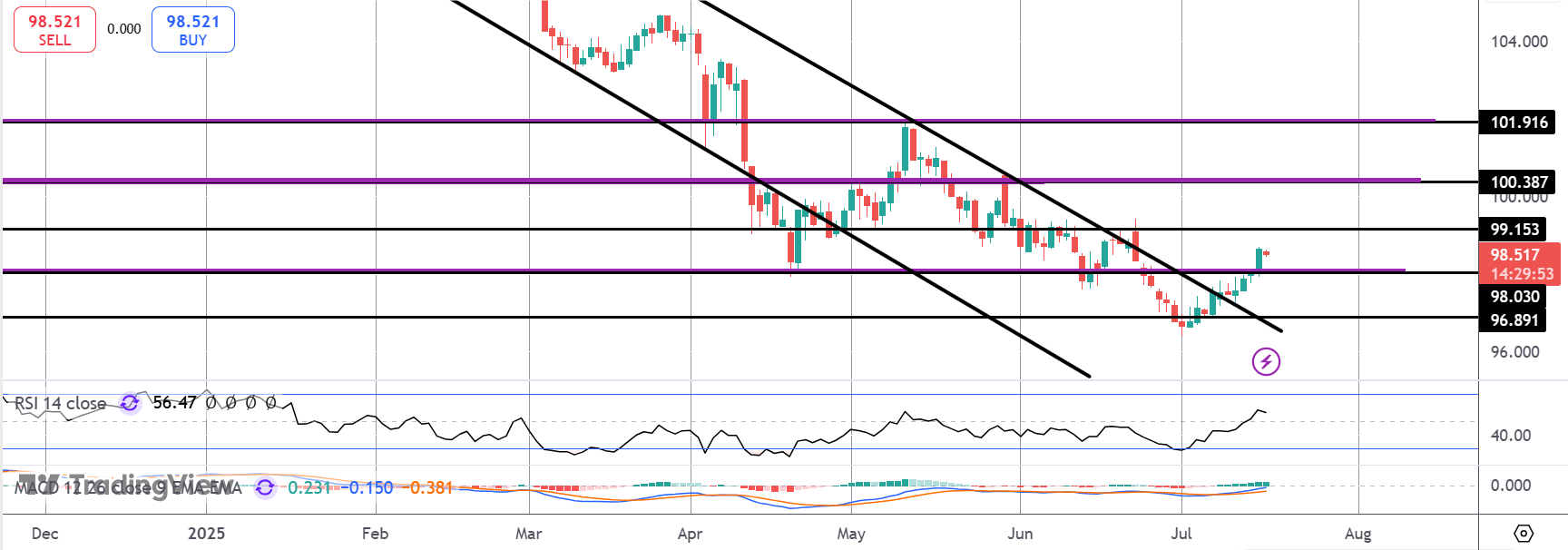

DXY

The rally in DXY has seen the market breaking above the bear channel highs and above the $98.03 level. While above here, and with momentum studies pushing higher, focus is on a continuation higher with $99.15 the next resistance level to watch ahead of the bigger $100 mark.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.