Dollar Potentially At Major Turning Point

-1720617158.jpg)

USD Shift

Over the past fortnight we’ve seen a clear shift in USD with the Dollar Index shedding around 1.2% from the June highs. This weakness comes despite the Fed striking a firmly hawkish tone at the June FOMC, slashing rate-cut projections through the remainder of the year while revising inflation forecasts higher. Indeed, many members were seen voicing support for fresh tightening should inflation persist at current level or increase again.

So, against this backdrop, why is it we’re seeing USD weakening?

Fed/Market Disconnect

As is often the case, the current price action in USD reflects traders’ future expectations more than being simply a reaction to the latest monetary policy outlook. While the June FOMC was clearly hawkish, Powell did note that the bank’s forecasts on inflation and rates were conservative, noting that there was still room for additional cuts depending on how inflation develops. Essentially, the read here for many traders is that, despite a more hawkish outlook, should inflation continue to fall, more than 1 cut is likely.

Data Weakness

Over the last 6 – 8 weeks we’ve seen a noticeable shift in US data with many key indicators coming in below forecasts (GDP, PCE, retail sales, ISM PMIs etc). Indeed, even the latest jobs data gave cause for concern: while the headline NFP was a touch above forecasts, the reading is still trending lower and wage growth was seen lower too while the unemployment rate was seen higher. Speaking yesterday, Powell referenced evidence of a cooling jobs market while noting that there is plenty of two-way risk in the US economy currently.

Market Pricing

The data weakness in recent weeks has seen the market repricing its rates outlook for the year ahead. After previously slashing September easing odds and pegging just one cut in either November or December, traders are now pricing a 70% likelihood of a September cut with at least one further cut now seen through year-end.

Inflation Remains Key

Regardless of the commentary we’re hearing, or the projections being made, inflation remains critical to determining US rates. The bottom line is that if inflation continues to fall, particularly if we see a quicker decline, current market easing projections look appropriate, making USD vulnerable to fresh downside. An accompanying dovish shift in the Fed outlook should amplify selling, as will any weakness in incoming US data.

Near-Term Focus

Tomorrow’s US CPI reading will be the key focus for traders ahead of the July FOMC. The market is looking for annualised headline CPI to sow to 3.1% in June, down from 3.3% prior. If seen this should keep current market projections as are, keeping USD under pressure. However, any downside surprise is likely to see easing expectations increase, leading USD down more firmly. Obviously, the risk to this view is that we see an upside surprise, in which case, near-term easing expectations are likely to weaken, allowing USD room to recover.

Technical Perspective

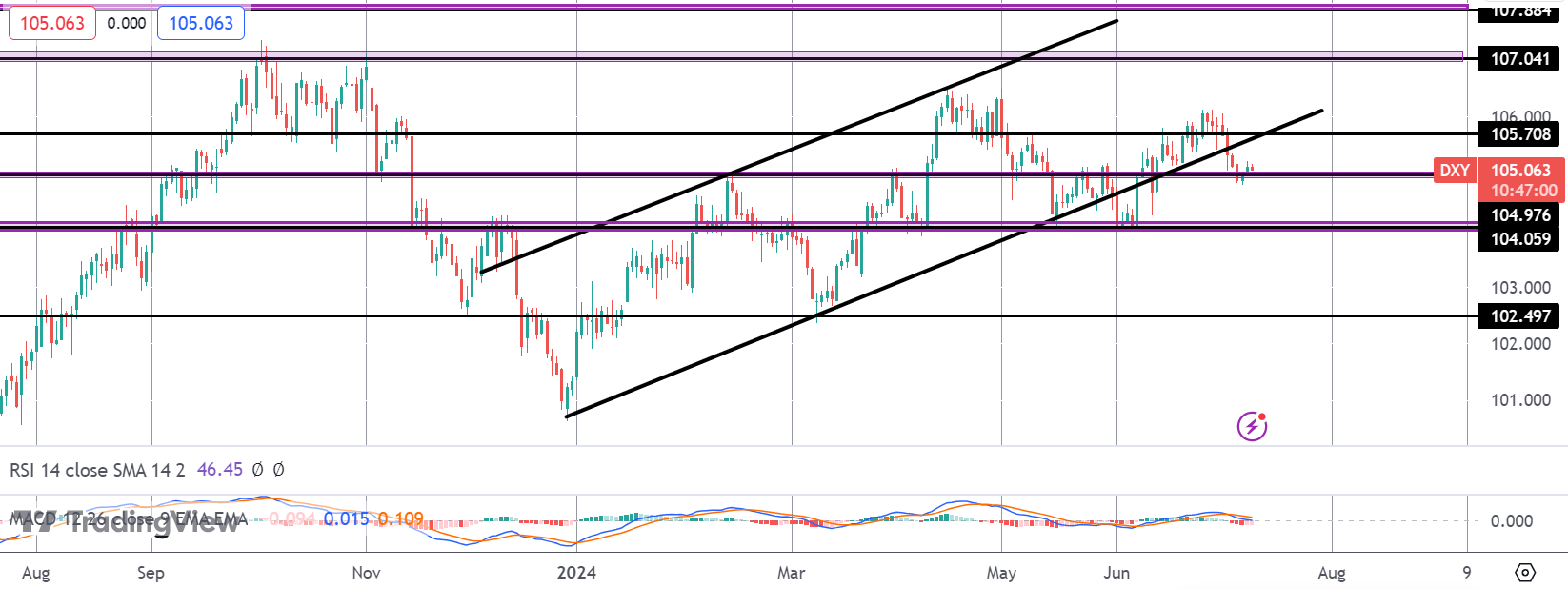

DXY

The selling in DXY has seen the index breaking down below the bull channel lows. Price is now sitting on support at the 104.97 level. However, with bearish MACD readings seen, the market remains vulnerable to fresh downside with 104.05 the next support to note. To the topside, if bulls can get back above the 105.70 level and back inside the bull channel, 107.04 will be the main objective.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.