Dollar Holding Support Ahead of Jobs Data

US Jobless Claims Up Next

The US Dollar remains in focus today as traders brace for the latest set of US weekly jobless claims. A weaker-than-forecast set of US labour market data on Friday prompted an aggressive shift in trader sentiment with investors now pricing in a much faster pace of US rate-cuts over the remainder of the year in response to growing recessionary risks. The US Dollar was seen falling sharply lower as traders moved to price in three cuts ahead of year end, up from 1 / 1.5 prior. With jobs market data trending lower, many players have cited increased recessionary risks, suggesting that the Fed has already been too slow in easing.

Data Forecast

Looking to today’s data, the forecast is for weekly unemployment claims at 241k, down from 249k prior. A reading at this level or below should see muted action in USD. However, if we see an upside surprise today, this could well provide the catalyst for a fresh leg lower in the Dollar.

Fed’s Barkin to Speak

Following that data, we’ll then hear from Fed’s Barkin. The Richmond Fed president has recently urged caution with cutting rates so it will be interesting to see if his view has shifted now. In light of a third consecutive drop in inflation and jobs data trending lower, if we do hear a dovish shift from Barkin today that should add to bearish sentiment in USD.

Technical Views

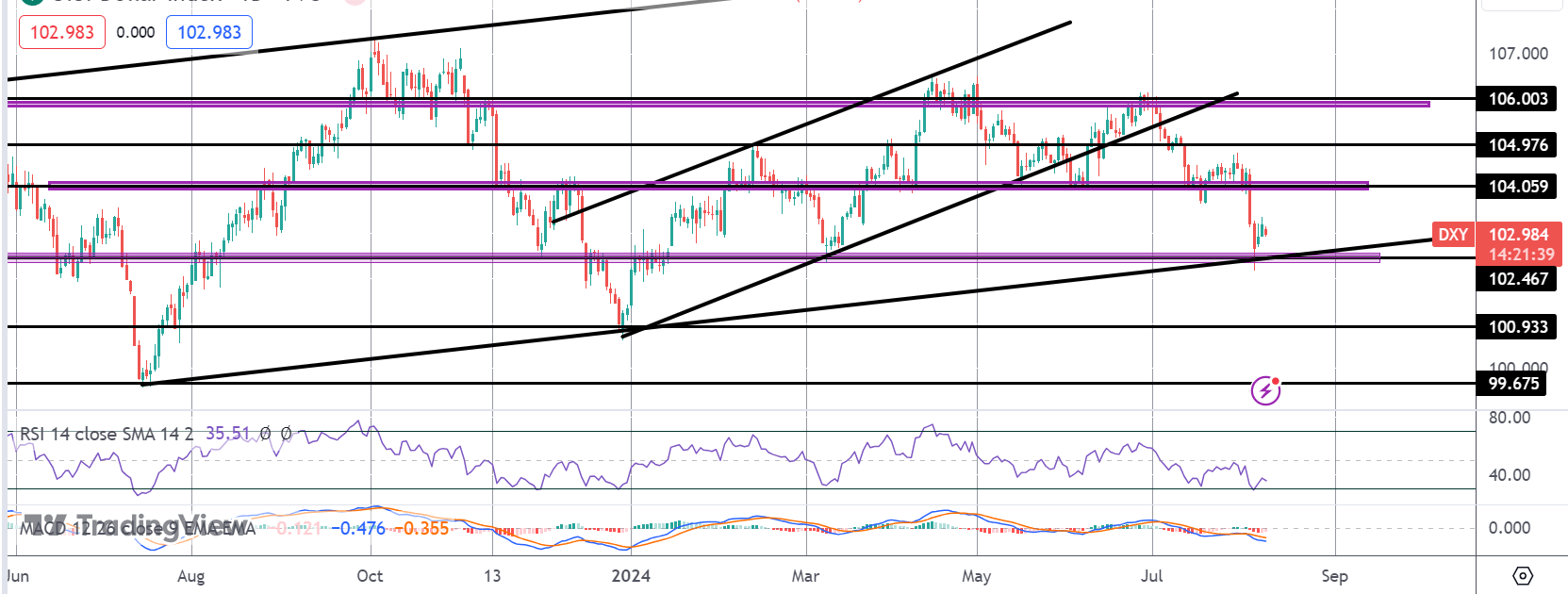

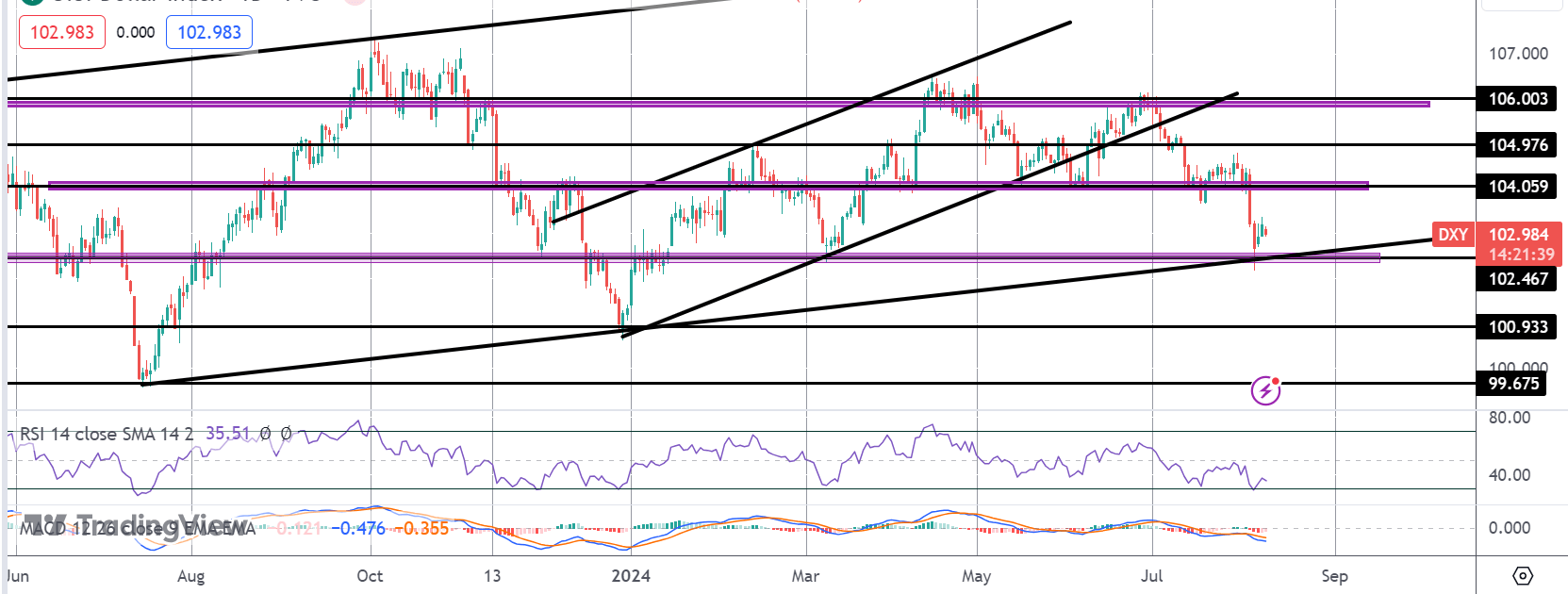

DXY

The sell off in DXY has seen the index breaking down below the 104.05 support with price now testing the 102.46 level and the bull channel lows. While this area holds, a recovery higher is still viable. Below here, however, focus turns to 100.93 in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.