Daily Market Outlook, September 12, 2022

Daily Market Outlook, September 12, 2022

Overnight Headlines

- ECB Governors See Rising Risk Of Rate Hitting 2% To Curb Inflation

- More Clear ECB Steps Needed If Inflation Lingers, Nagel Says

- ECB’s Knot Urges More Hikes To Tackle ‘Big’ Inflation Risk

- ECB’s Centeno Urges Cautious Next Steps After Historic Rate Hike

- US Inflation Showed Signs Of Easing In Several Industries In August

- Biden To Hit China With Broader Curbs On U.S. Chip And Tool Exports

- BoJ Set To End Covid-Relief Scheme, But No Change To Loose Policy

- New Zealand Economists See Growth Slowing Through to 2024: NZIER

- Xi To Meet Russia's Putin In First Trip Outside China Since Covid Began

- Sweden Opposition Overtakes Premier’s Bloc In Election Tally

- Russian Defenses Crumble as Ukraine Retakes Key Territory Back

- Euro Jumps Amid Hawkish ECB Signals, Dollar Heavy Before U.S. CPI

- Oil Opens Week Lower As Traders Weigh Demand, US Price-Cap Plan

- Asia Stocks Rally, Dollar Restrained Before Inflation Test - China Closed

- Crash-Obsessed Traders Splurge On Options At Two-Decade High

The Day Ahead

- Despite expectations of further outsized interest rate moves from some of the major central banks around the world, equities across the Asia-Pacific region are largely trading higher this morning. In Japan, sentiment is being supported by news that the country is planning to scrap a 50,000 people per day limit on the number of foreign arrivals by October, a sign that it is further relaxing its Covid restrictions.

- The hawkish messaging of most major central banks remained in place over the past week as officials signalled their continued commitment to act to lower inflation. That maintained general upward pressure on global government bond yields, with benchmark US 10year Treasury yields, for instance, rising back above 3.3%. The European Central Bank (ECB), which only started raising interest rates in July, increased them again last Thursday, this time by a record 75bp. With inflation remaining “far too high”, President Lagarde pledged to hike rates further in the next few meetings despite forecasting a marked economic slowdown next year. The possibility of another 75bp rise next month has not been ruled out. Similarly, remarks from US Federal Reserve Chair Powell also suggest that another 75bp increase is on the table at their meeting next week (20/21 September). Powell stated that “we need to act now forthrightly”. Meanwhile, on the domestic front, markets continued to see a strong possibility of a 75bp hike from the Bank of England at its next meeting, which has been pushed back from this Thursday to the 22nd of September – a day after the Fed meeting.

- A busy UK data slate this week is likely to provide key inputs into the MPC’s decision. Earlier this morning, the latest monthly GDP report for July showed a smaller-than-expected rise of 0.2% m/m, with weakness in industrial (-0.3% m/m) and construction (-0.8% m/m) activity tempering the impact of a strong rebound in services activity (0.4% vs -0.5% in June). As a guide, if the level of economic activity was unchanged in August and September, GDP growth in Q3 would be flat, versus the Bank of England’s forecast of a 0.4% rise.

- The rest of the day is void of any major data with comments from two ECB officials (Guindos and Schnabel) providing the focus for markets. Following the ECB’s decision to hike by 75bp at its meeting last week, the market will be watching for clues that the Governing Council will be following up with a similar move at its next meeting in October.

- Early tomorrow morning at 7am, a tight UK labour market is expected to be reaffirmed in the latest release, supporting further policy tightening. There were some tentative signs of softening in last month’s report, including falling (but still high) levels of unfilled vacancies. Despite expecting some softening in employment growth, markets expect the unemployment rate to fall to 3.6% in the three months to July due to rising inactivity and regular pay growth (excluding bonuses) to accelerate to 5.0%. Later in the week, UK inflation and retail sales reports for August are due.

CFTC Data

- USD long grows despite EUR bid sub – parity; GBP, JPY sellers out in force

- USD net spec long rose in Aug 31-Sep 6 period, $IDX +1.38%

- EUR specs +11,327 contracts on dip to 2022 low, now short 36,349

- JPY specs -16,658 amid $JPY +2.88%, now long 58,189 contracts

- GBP$ -1.15% in period, specs -21,262 contracts now short 50,432

- AUD specs buy tiny on dip, CAD specs -6,629 contracts now +17,910

- BTC +1.38% in period specs +26 contracts long increased to 1,322

- Source: Reuters Data

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9925 (429M), 0.9950-55 (453M), 1.0000 (760M)

- 1.0010-20 (881M), 1.0050 (473M), 1.0065-75 (715M)

- 1.0080 (352M), 1.0100 (758M), 1.0150 (274M), 1.0200 (387M)

- USD/JPY: 141.50 (555M), 142.00 (280M), 142.50-52 (711M)

- 143.00 (760M)

- USD/CHF: 0.9600 (600M)

- GBP/USD: 1.1500 (310M), 1.1875 (955M)

- AUD/USD: 0.6900 (228M), 0.6940 (365M), 0.7000 (201M)

- USD/CAD: 1.2850 (260M)

Technical & Trade Views

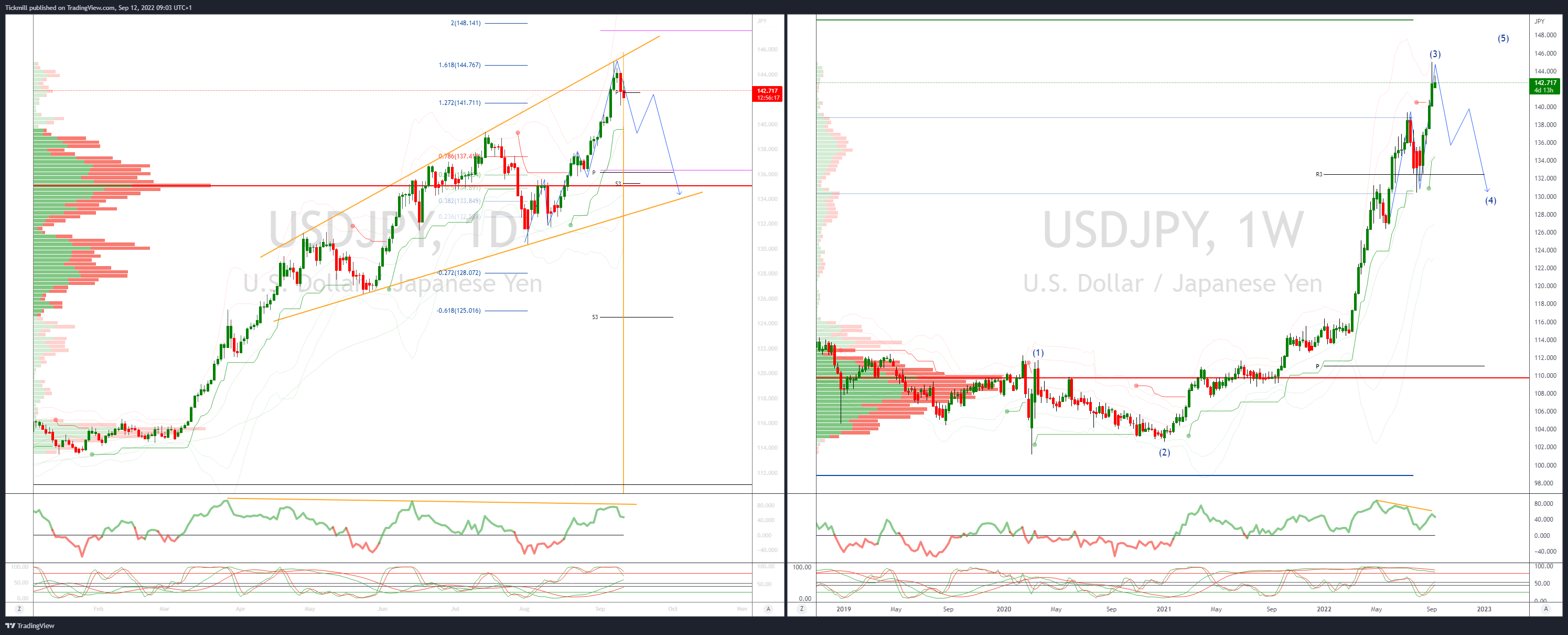

EURUSD Bias: Bearish below 1.0250

- Sharp early spike to 1.0130, but remains bid, up 0.2% from 1.0046 NY close

- Positive knee jerk reaction to Ukrainian forces weekend success

- Attention swings to the Russian response to events in Ukraine

- 20 day VWAP bands contract - no strong bias - consolidation phase

- Close above 1.0017 was a positive signal

- Targets a test of 102.50

- 1.0050 472mln 1.0070/80 681mln and 1.0100 759mln close strikes on Monday

- 20 Day VWAP bullish, 5 Day bullish

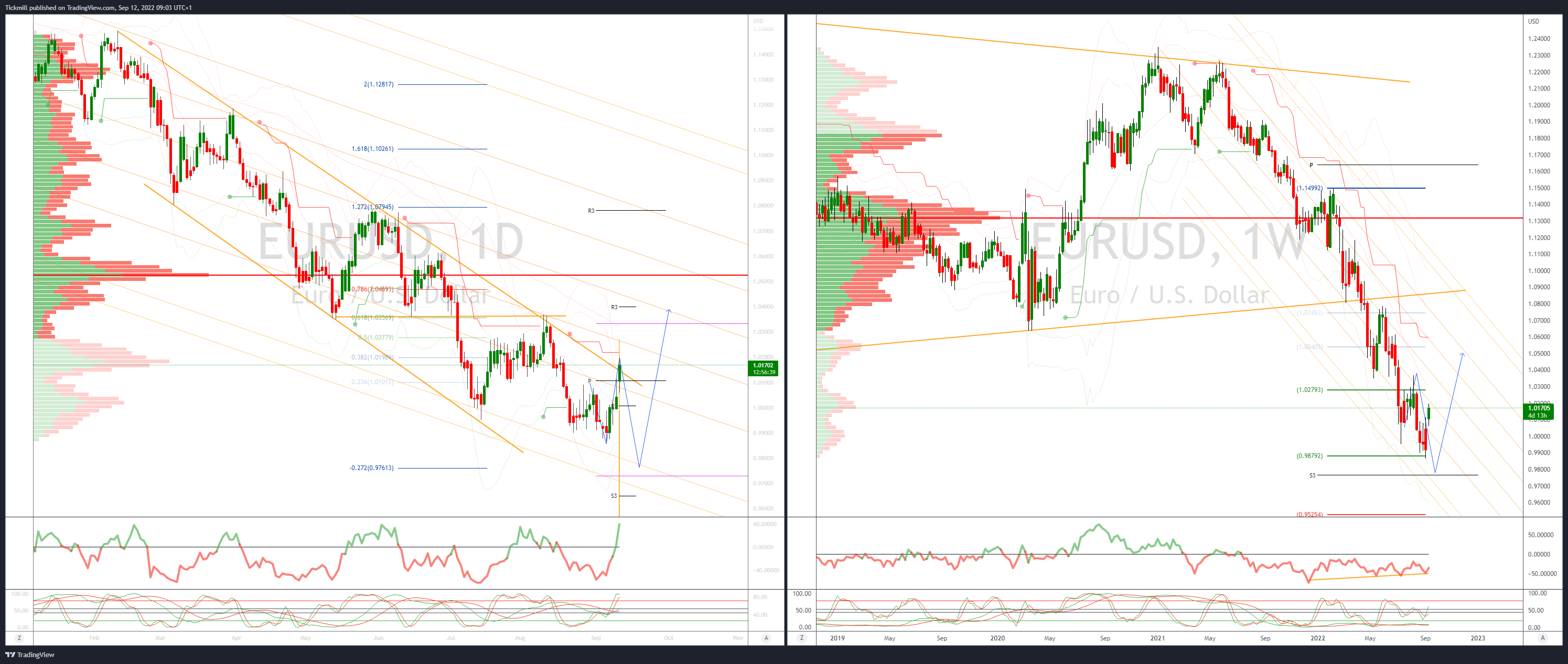

GBPUSD Bias: Bearish below 1.19

- Bid – glimmer of hope for a Northern Ireland deal

- +0.25%, towards the base of a 1.1602-1.1681 range - busy early

- Volatility early linked to knee jerk response to Ukraine gains

- FT - Brussels offers to reduce Northern Ireland border controls

- If PM truss is flexible, a N.Ireland deal viable - potential GBP positive

- Close above 1.1560 was a positive

- Targets a test of 1.1725 pivotal

- 20 Day VWAP is bullish, 5 Day bullish

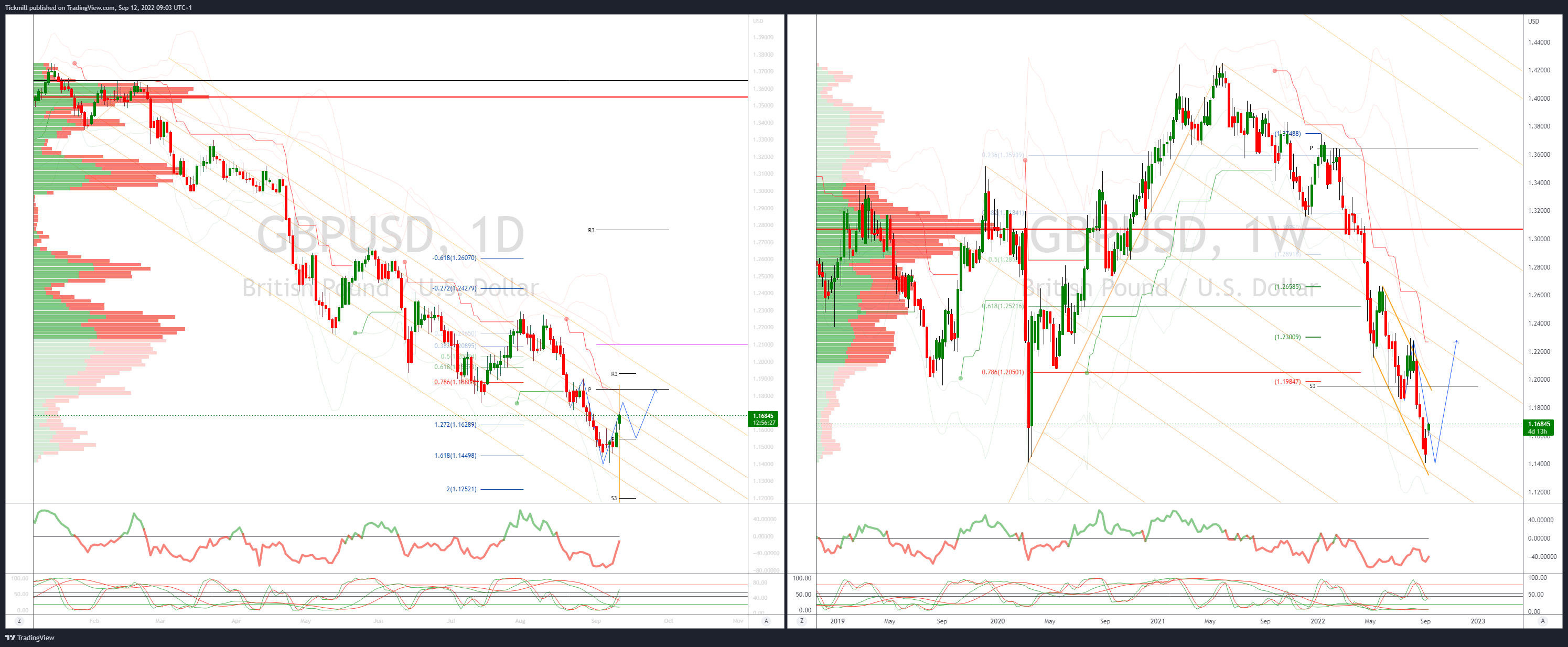

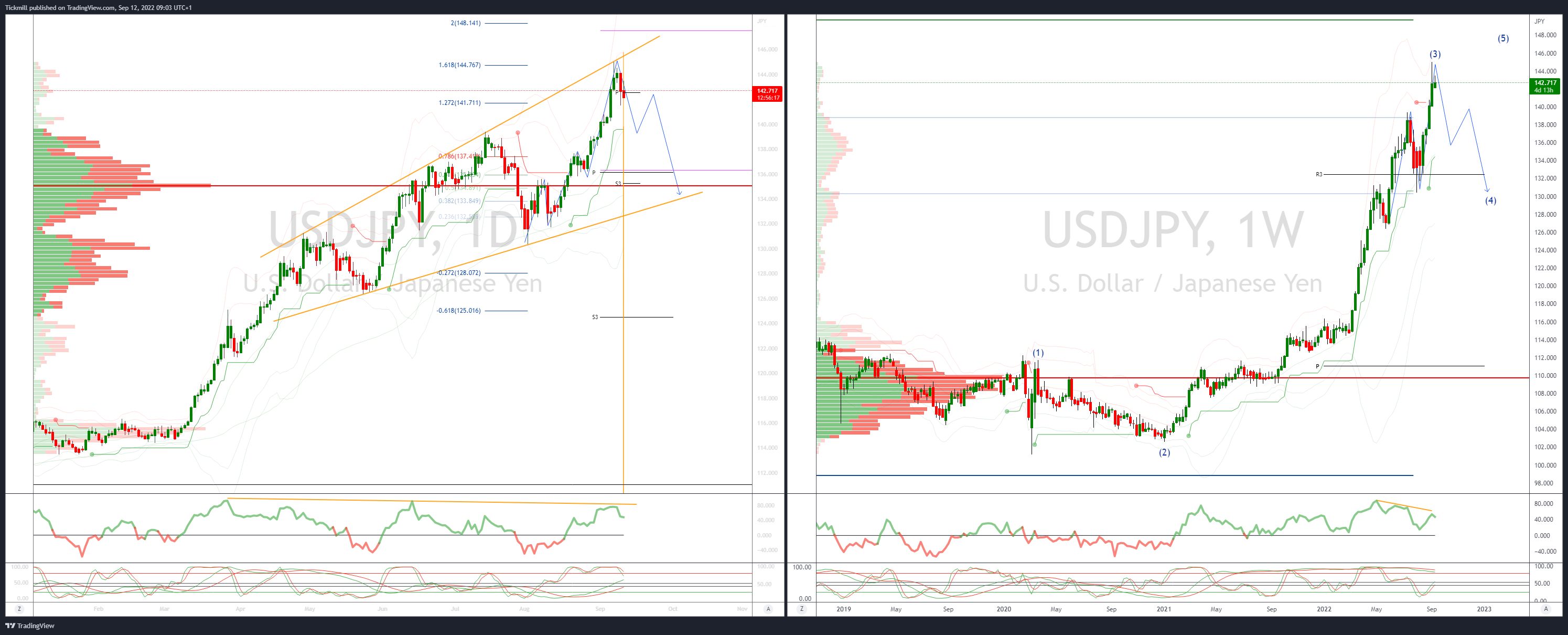

USDJPY Bias: Bullish above 139

- USD/JPY as low as 141.51 EBS Friday before steadying, back to 142.80

- Asia 142.05-91 bounce

- Japanese importers definitely looking to buy current 'dip' from 144.99

- Specs too looking to put on more longs for now but with caution

- More key retracements levels lower, Fibo 38.2% of 130.40-144.99 139.41

- Recent August 2-September 7 move up very fast, 14.59 yen

- Feeling JPY weakness not excessive till closer to 150

- Option expiries in area today - 142.50-65 total $831 mln, 143.00 $760 mln

- Large option barriers still up at 145.00, specs sights still on test

- 20 Day VWAP is bullish, 5 Day bearish

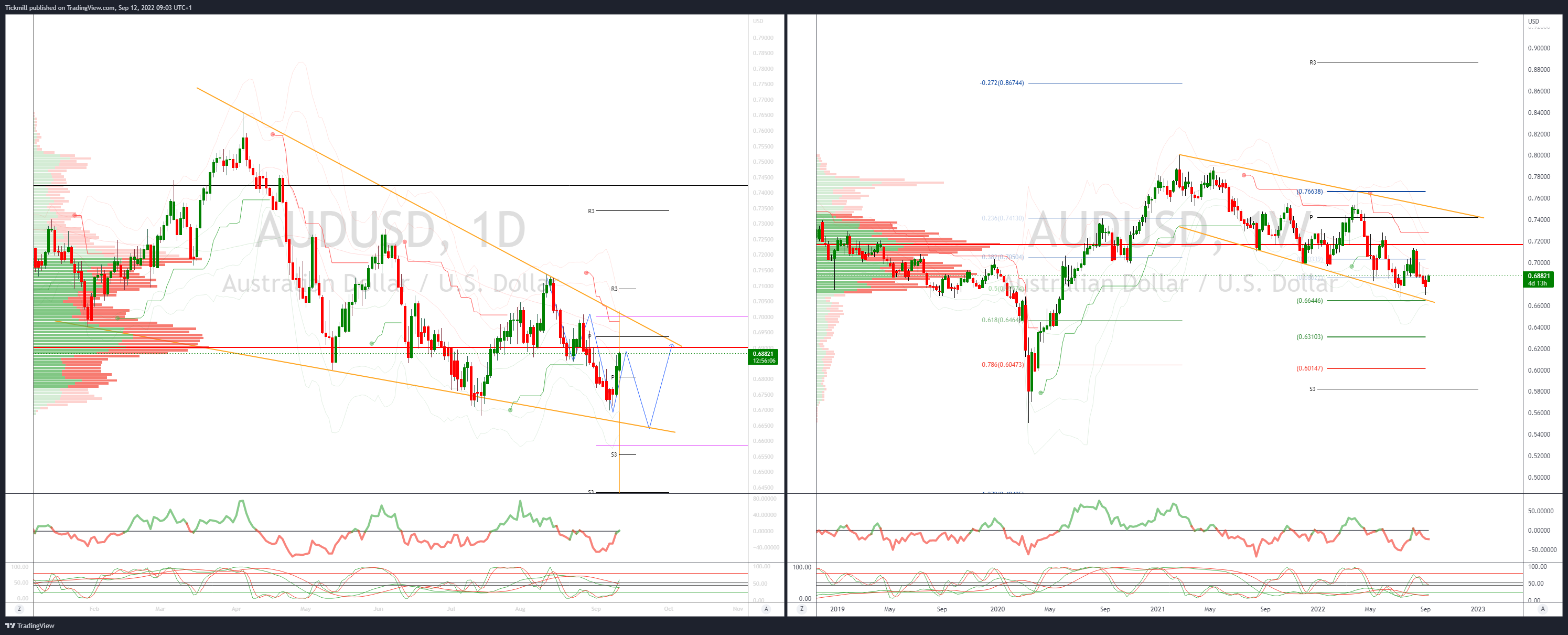

AUDUSD Bias: Bearish below .70

- AUD/USD gapped down to 0.6797 early Asia after closing Friday @ 0.6846

- Move appeared to be cross driven as EUR/USD gapped higher at the same time

- EUR/AUD short covering may have been tied to Ukraine military success

- AUD/USD quickly filled the gaps when market became more liquid

- It traded back to 0.6844 before easing again later in the morning

- EUR/AUD remained bid and was up 0.60% into the afternoon

- The AUD/USD settled around 0.6825/30

- 0.6870 and break would be bullish

- The next level of resistance is at the 50% of the 0.7136/0.6699 at 0.6917

- Support is at 0.6801 and a close below would ease upward pressure

- 20 Day VWAP is bullish, 5 Day bullish

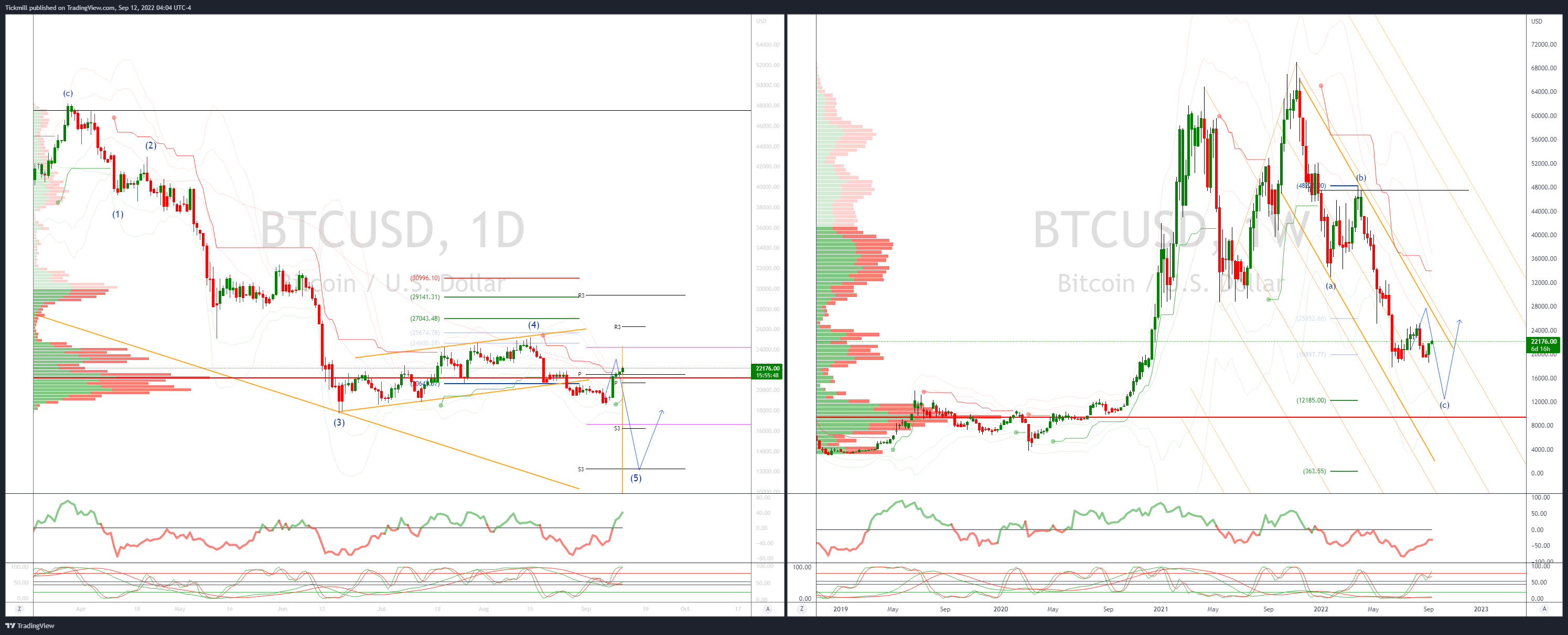

BTCUSD Bias: Bearish below 25.3K

- Bitcoin rebound rally might fizzle unless 23.3K breaks

- BTC trades 22.2K early Mon

- Mon close below 21.9k may overturn rally

- Below 21,227 VWAP band marks exit from bullish channel

- Through 25.3k will expose much more room till $30k psych barrier

- 20 Day VWAP is bullish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!