Daily Market Outlook, July 20, 2022

Daily Market Outlook, July 20, 2022

Overnight Headlines

- Dollar Loses Steam, Euro Heaves Sigh Of Relief Ahead Of ECB

- Asian Equity Markets Broadly Higher; US Futures Also Gain

- Netflix Rallies 8% After Hours After Losing Fewer Subscribers

- Biden To Announce Climate Actions, Not Yet Declare Emergency

- Biden Approval Rating Falls To 36%, Matching The Record Low

- Italy Faces Parliamentary Showdown On Government Survival

- Truss Eyes Leadership Runoff With Sunak As Tories Vote Again

- Bracing For Russian Gas Cuts, EU Readies Plan To Cut Demand

- Putin: Ukraine Did Not Make Good On Preliminary Peace Deal

- China Leaves Loan Prime Rate Lending Benchmarks Unchanged

- Chinese Covid-19 Cases Near 1,000 In A Test Of Zero-Tolerance

- RBA Governor: Need To Chart ‘Credible Path’ To 2-3% Inflation

- Oil Prices Fall On Inflation Concerns, Anticipated Stock Builds

The Day Ahead

- Market risk tone brightened during the Asian trading session. It followed positive closes in Europe and the US yesterday. However, it remains to be seen whether the latest equity market rally continues, as markets assess how quickly and how far interest rates will rise, and whether the impact on economic growth is appropriately reflected in asset prices. Meanwhile, media reports suggest Russian energy supplies to Europe via Nord Stream will restart, albeit at reduced capacity.

- UK headline CPI inflation, released earlier this morning, increased for a ninth consecutive month, to a new 40-year high of 9.4% in June, lifted by higher food and petrol prices. The outturn was above a forecast rise to 9.3% from 9.1% in May. The core measure (excluding food and energy) fell for a second month, to 5.8% from 5.9%, albeit a marginally smaller decline than forecast, and it remains at an elevated level. The data will maintain pressure on the Bank of England to continue to raise interest rates, with the next policy update due in early August. Yesterday, Governor Bailey said that a 50bp hike is ‘on the table’ but ‘not locked in’.

- In contrast to other major central banks, the Bank of Japan is expected to keep policy unchanged. It will announce its policy decision early tomorrow. The ECB policy update on Thursday is the key focus for markets, with reports suggesting that the Governing Council is considering a 50bp rise. The consensus is that it will raise rates by 25bp, the first increase since 2011, and possibly by 50bp in the following meeting in September.

- Today’s Eurozone data are likely to receive limited attention, but they include the current account and consumer confidence. The current account balance last month swung into deficit for the first time in over a decade, while we anticipate a new low in consumer confidence – both related to the issue of energy security.

- Canadian CPI inflation data and US existing home sales are due this afternoon. Headline annual CPI is expected to rise to 8.4%, while existing home sales may have fallen for a fifth straight month.

- In UK politics, the final round of the Conservative leadership contest takes place today, with the final two candidates selected by the party’s MPs. The two will then go forward for a vote among the wider party membership and a new PM is expected in early September. In Italy, PM Draghi will decide whether to stay in his post ahead of a scheduled confidence vote this evening.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0000 (960M), 1.0100 (1.55B)

- USD/JPY: 137.00 (625M), 137.75 (835M), 139.00 (1.05B), 140.00 (705M)

- GBP/USD: 1.1980 (449M)

- USD/CAD: 1.2800-05 (550M), 1.2990-95 (499M), 1.3285-90 (980M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.0350

- Move higher Tuesday due to risk-on mood and hawkish turn in ECB expectations

- Risk for EUR/USD would be if ECB 'only' hikes 25 BPs when they meet Thursday

- Resistance 1.0250/60, support 1.0100-05, 1.0070-75

- Price testing the 20 Day Bearish VWAP

- 20 Day VWAP is bearish, 5 Day bearish

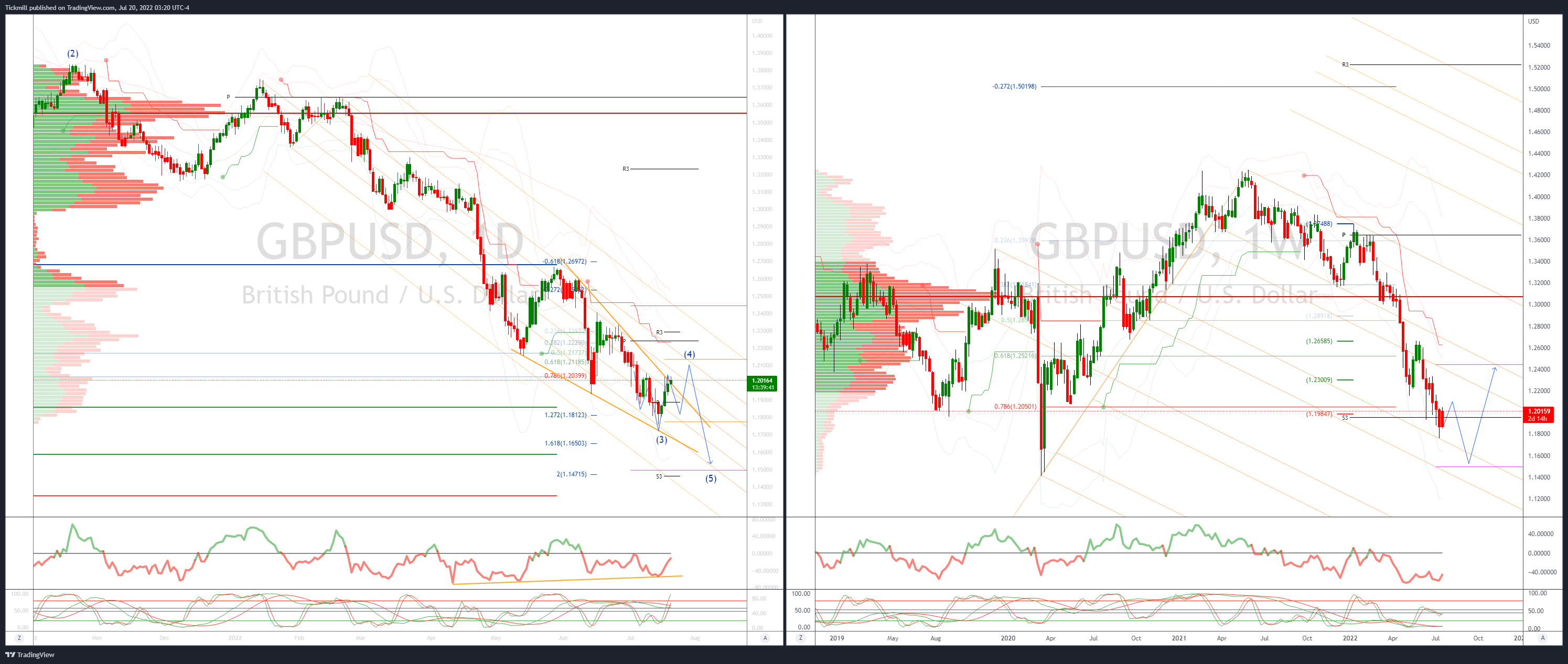

GBPUSD Bias: Bearish below 1.2150

- UK June CPI above forecast, new 40yr highs at +9.4% YY

- New 40-year high for UK inflation adds weight to a potential 50bps move by the BoE

- BoE's Bailey commented Tuesday that 50 bps hike on the table for Aug 4 meeting

- Sunak, Mordaunt and Truss head into key leadership vote Weds

- Offers sited at 1.2050 bids 1.1890

- 20 Day VWAP is bearish, 5 Day bearish

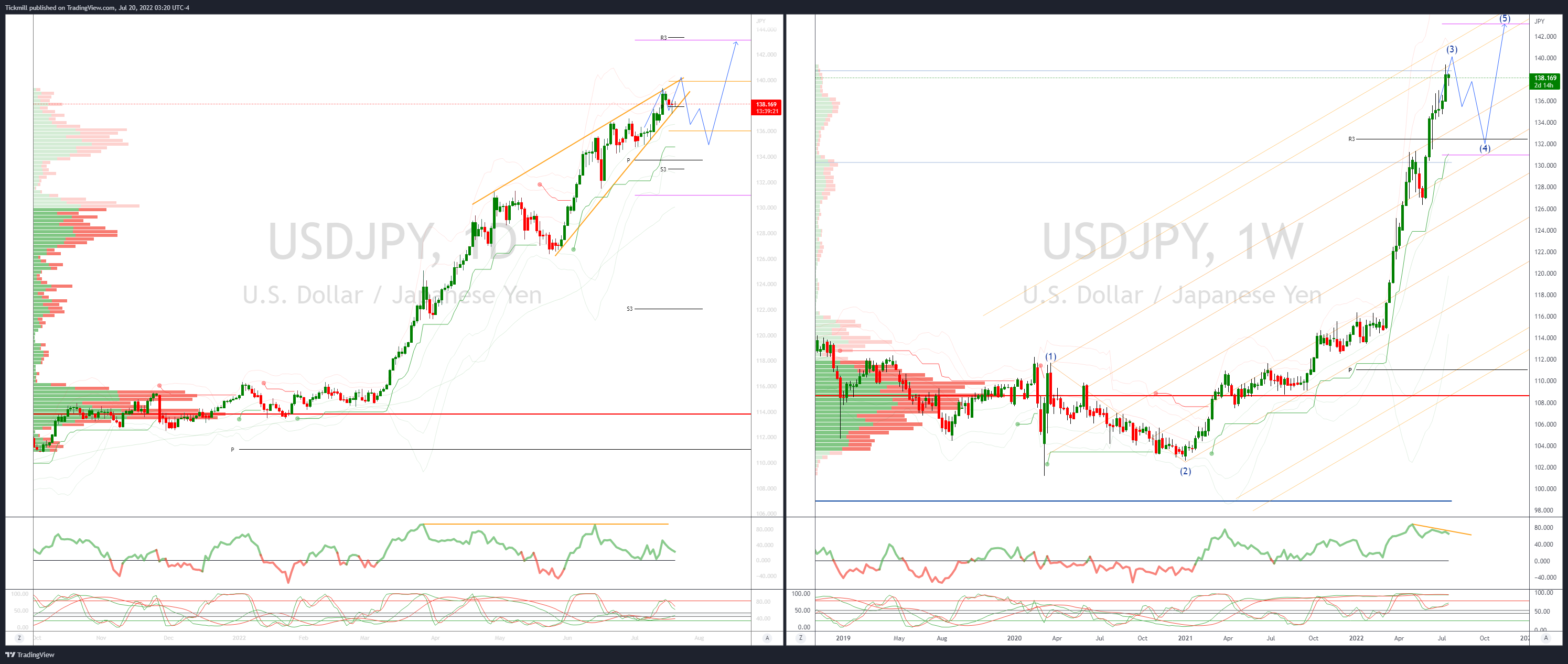

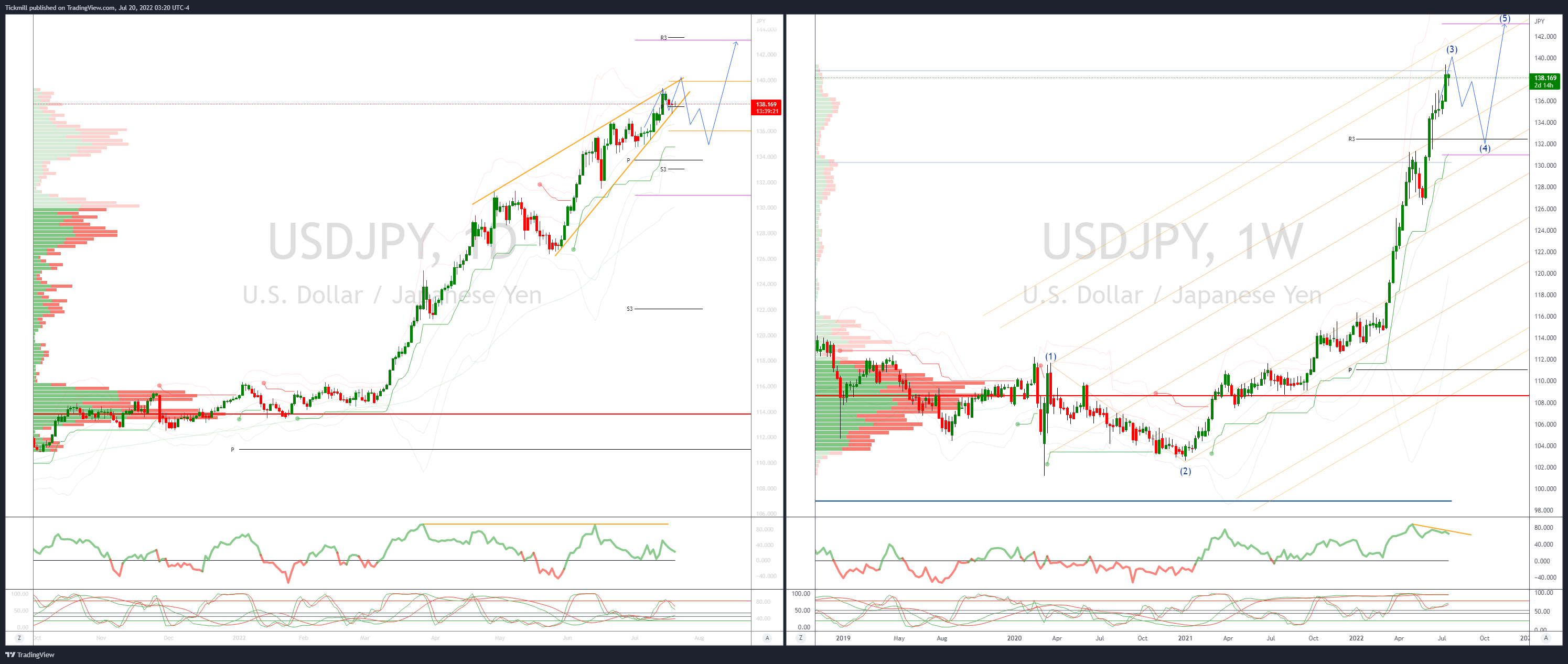

USDJPY Bias: Bullish above 134

- USD/JPY rotating in quite Asian session bid above 138

- Higher US yields and better risk tone add support

- Exporter offers 138.50 Importer bids 137.50

- Size option expiries 139.00 $1.1 bln roll off today

- JPY crosses bid with shift in central bank expectations

- 20 Day VWAP is bullish, 5 Day bullish

AUDUSD Bias: Bearish below .7050

- AUD/USD rallies in unison with equity risk on tone

- U.S. futures bid Netflix shares up over 8% in post market.

- RBA Governor Lowe hints at continued rate rises

- Market starting to price a 75bps August RBA hike

- June quarter CPI eyed next week market sees a 6%+ print

- Price testing pivotal .6940/50 resistance through here opens .70 test

- 20 Day VWAP is bullish, 5 Day bullish

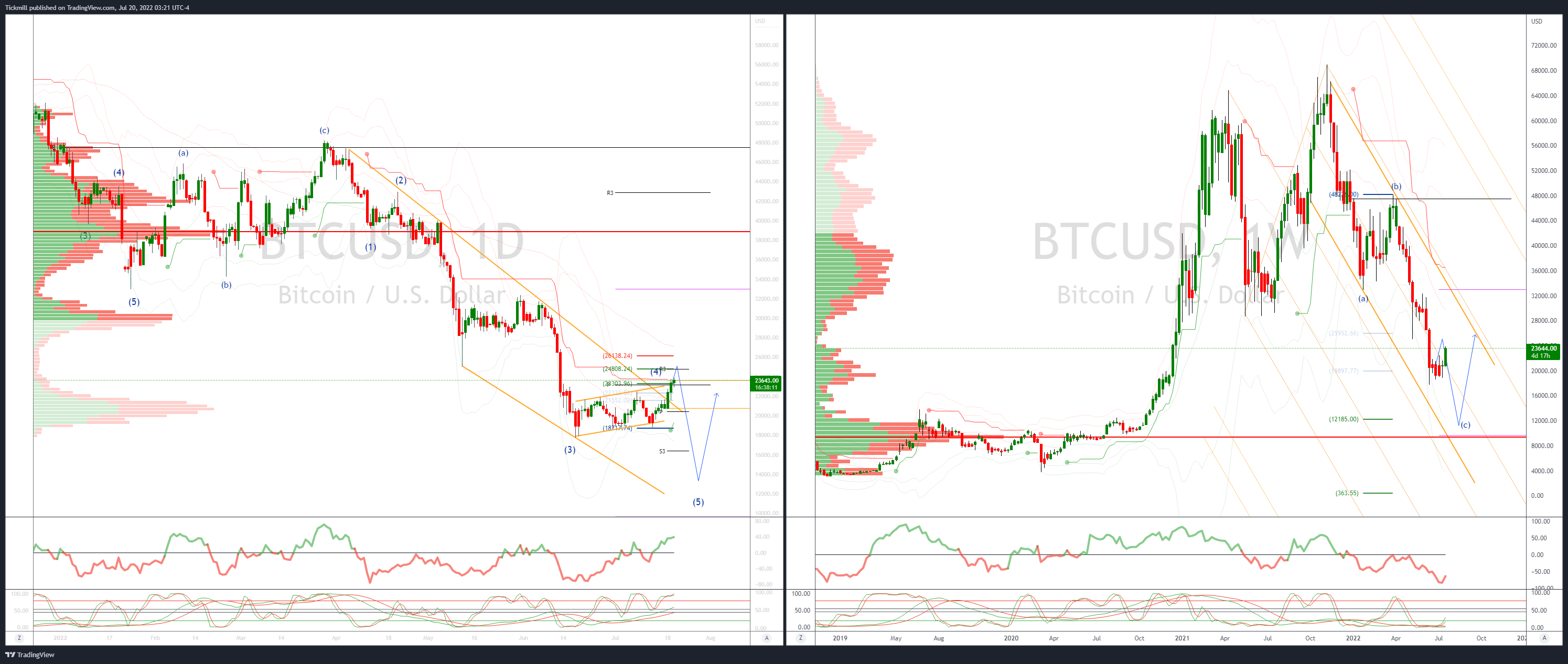

BTCUSD Bias: Bullish above 22k

- Crypto stocks bid as bitcoin rises to test towards 23,800

- Bitcoin trading at best levels for over a month bid with Nasdaq.

- Crypto miners leap: Hut 8 Mining , Marathon Digital , Riot Blockchain , Core Scientific rise between 13% and 25.7%

- Blockchain farm operator Bitfarms Ltd jumps 14.3%, BTC buyer MicroStrategy gains 18.6%

- Crypto exchange Coinbase Global up 11.8%

- Bulls eye a 25k test next, support sited back at 22k

- 20 Day VWAP is bullish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!