Daily Market Outlook, August 2, 2022

Daily Market Outlook, August 2, 2022

Overnight Headlines

- Biden Team Tries To Blunt China Rage As Pelosi Heads For Taiwan

- Chinese Leaders Report GDP Goal Is Guidance, Not A Hard Target

- Several China’s Warplanes Fly Close To Taiwan Strait Median Line

- Sec Blinken Dodges Question On US Return To Iran Nuclear Talks

- Biden, Putin Strike Conciliatory Tones As Nuclear Arms Talks Start

- Democrats Side Deal With Manchin Would Speed Up Gas Projects

- US Treasury Raises Quarterly Borrowing Estimate To $444 Billion

- Japanese Finance Minister Suzuki Frets About Hectic Yen Swings

- Australia Central Bank Raises Rates 50bp To 1.85%, As Expected

- UK PM Candidate Truss Lifted By Former Rival Mordaunt Backing

- Italy Right-Wing Favourites See Room To Revamp Recovery Plan

- Yen Recovery Continues On Lower US Yields As Markets On Edge

The Day Ahead

- Asian equity markets are down sharply this morning. US-Sino relations are in focus as US Congressional leader Pelosi seems set to begin a visit to Taiwan today despite objections from China. She may meet with President Tsai tomorrow. A US National Security spokesperson said that the trip should not be seen as a provocation. However, the Chinese have warned of “grave consequences”. The Australian central bank as expected raised interest rates by 50 basis point the fourth consecutive increase since May. It also said that it was committed to bringing inflation down but that rates were “not on a pre-set path”.

- There are no major data releases today. However, in the US the June JOLTS survey of job openings and labour market turnover will provide further detail on employment trends. The main monthly report for June that was released a few weeks ago showed employment growth slowing but overall, the message seemed to be that the labour market is still tight. The same message is expected from today’s report. Job openings and turnover are both projected to have slipped but with demand for labour continuing to run ahead of supply. This is important not least because US Federal Reserve policymakers have cited that as evidence the economy is not in recession despite confirmation GDP fell in the first half of 2022. They also remain concerned that labour market tightness may further fuel wage growth.

- Several Fed policymakers seem likely to touch on those topics in speeches today. A key theme of last week’s Fed monetary policy update, when interest rates were raised again, is that policymakers are still more concerned about inflationary pressures than they are by signs that economic growth has stalled. Today’s speakers seem set to once again strongly emphasise that message. Financial markets in contrast appear increasingly convinced that a sharp slowdown in growth is the bigger risk. So, it will be very interesting to hear to what extent today’s speakers try to push back against that sentiment.

- Overnight Australian retail sales and the China Caixin services index will provide updates on trends in the Asia-Pacific region. Today’s interest rate rise indicates that the Australian central bank is currently more concerned about inflation but markets will be looking for signs that monetary policy tightening may be raising downside growth risks. Meanwhile, the Caixin comes in the wake of other Chinese PMI outturns for July having disappointed.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0240 (556M)

- EUR/GBP: 0.8645 (481M), 0.8660-65 (592M)

- AUD/USD: 0.7160 (641M). NZD/USD: (380M)

Technical & Trade Views

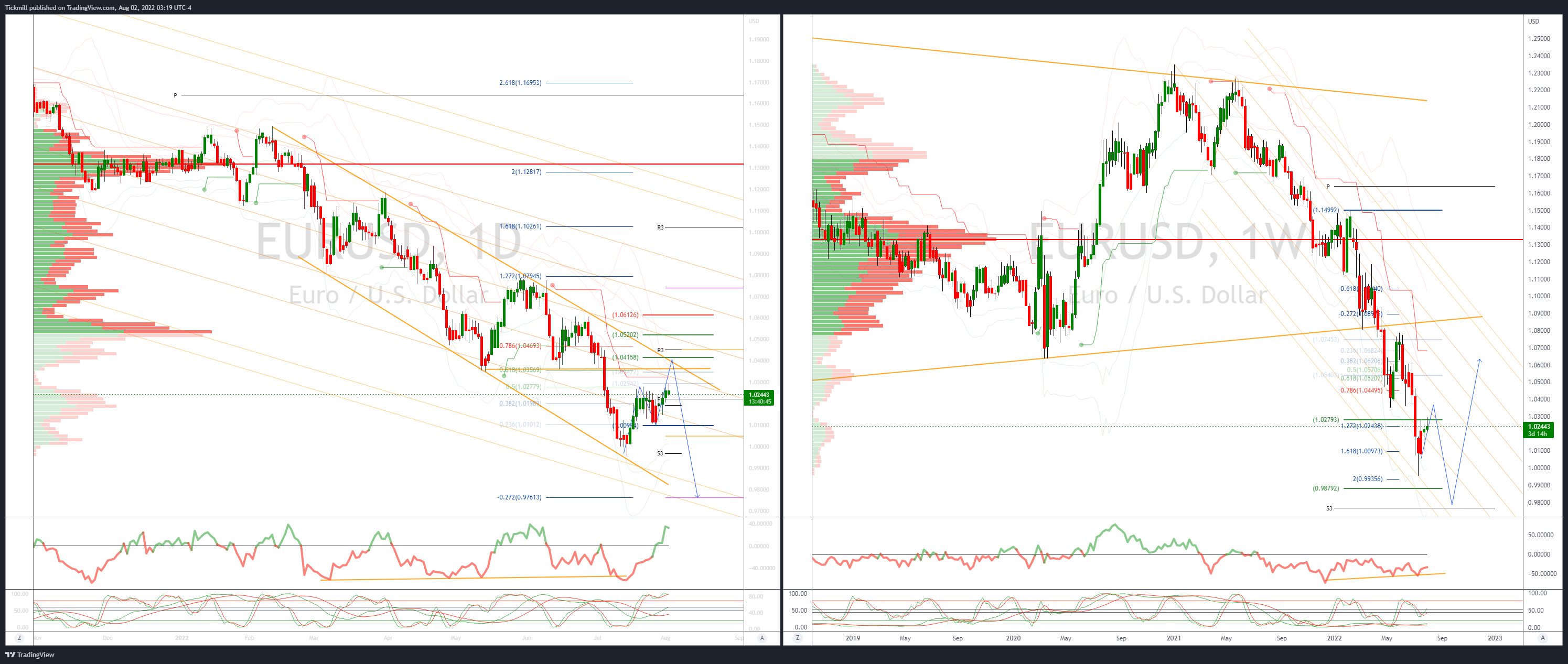

EURUSD Bias: Bearish below 1.0350

- Pelosi inspired geopolitical fears adding to global growth worries

- Asia was risk-off and resulted in EUR/JPY selling at various stages

- It also weighed on US yields, which helped to underpin the EUR/USD

- Resistance 1.0250/60 stronger offers seen to 1.0350/60, support 1.0100-05, 1.0070-75

- 20 Day VWAP is bullish, 5 Day bullish

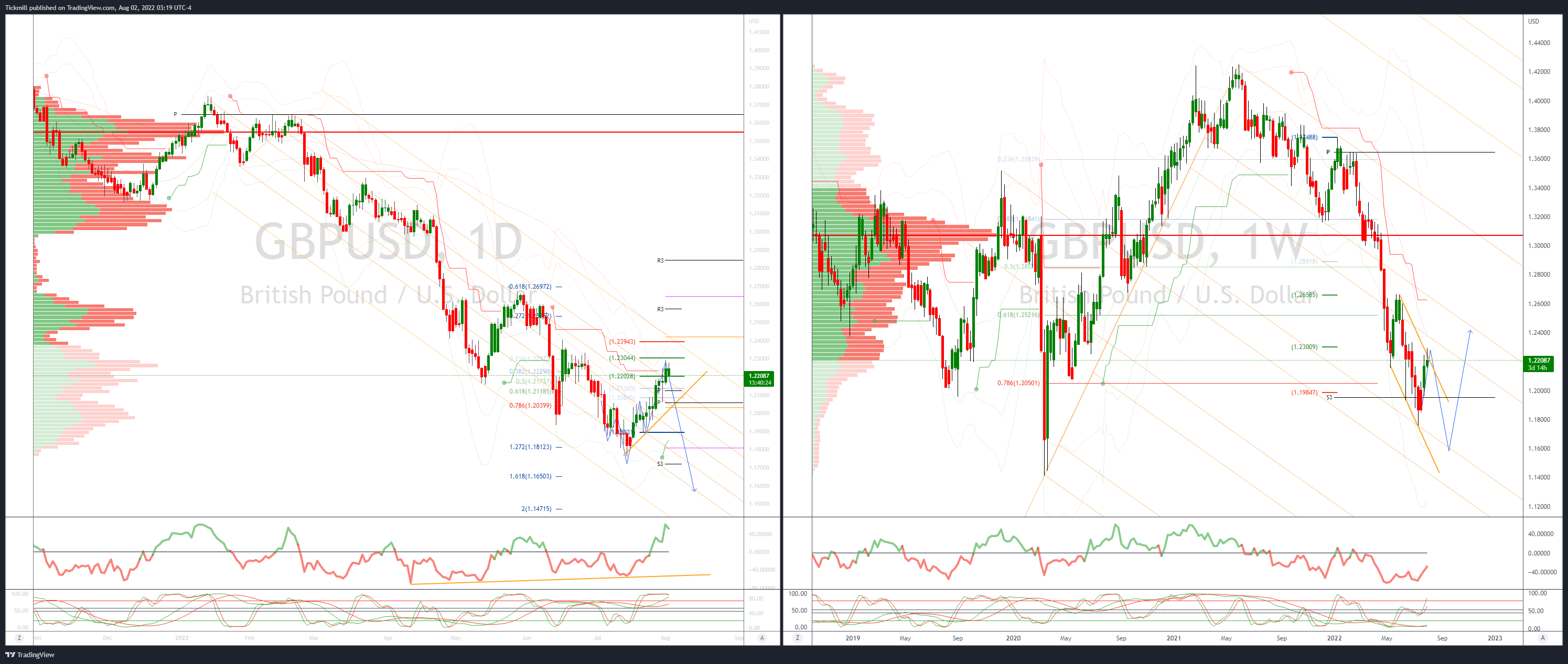

GBPUSD Bias: Bearish below 1.2280

- Steady in a 1.2212-1.2279 Asian range, off its best levels as LDN starts

- Risk off, awaiting China response to Pelosi Taiwan visit

- BoE rate decision Thursday; 50 bps hike is consensus forecast

- Offers sited at 1.2280/1.23 bids 1.2090

- 20 Day VWAP is bullish, 5 Day bullish

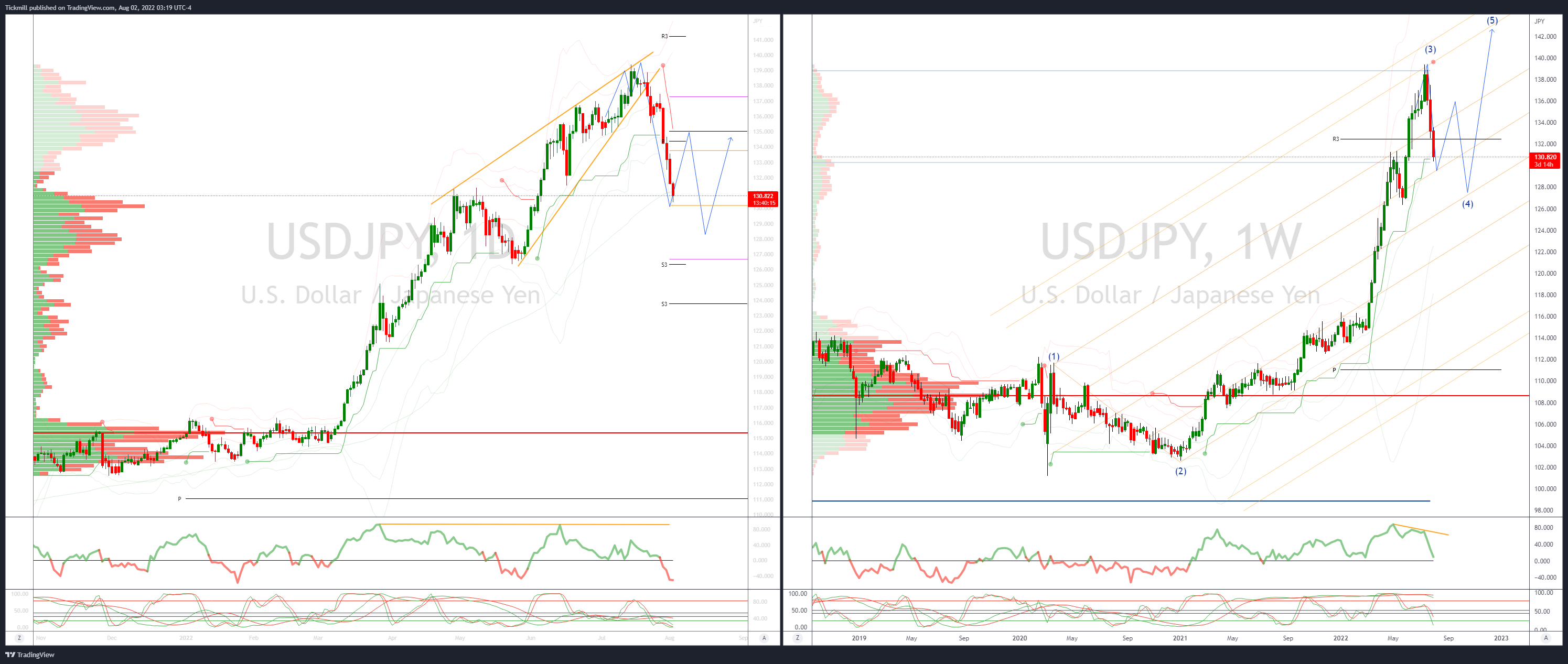

USDJPY Bias: Bearish below 134

- Japanese importers nowhere to be seen, biding time awaiting lower levels

- Japan FinMin Suzuki jaw-boning

- Suzuki again warned of rapid FX moves, this time to downside

- Drop defusing implications of ccy manipulation, purposely weakening JPY

- Bears target a test of 130

- Offers seen at 134

- 20 Day VWAP is bearish, 5 Day bearish

AUDUSD Bias: Bearish below .7050

- RBA statement similar to the July's and signals more tightening to come

- There weren't any hawkish surprises, but RBA retaining hawkish bias

- AUD/USD was under pressure earlier on heavy AUD/JPY selling out of Tokyo

- Risk-off mood prevailed in Asia with the AXJ index falling over 1.5%

- Geopolitical fears on Pelosi's Taiwan visit adding to global growth concerns

- With RBA decision out of the way, AUD/USD will be driven by external factors

- Offer at .70 being eroded as price is accepted above .70 bulls target .71 test

- AUD/USD support now sited at .6890

- 20 Day VWAP is bullish, 5 Day bearish

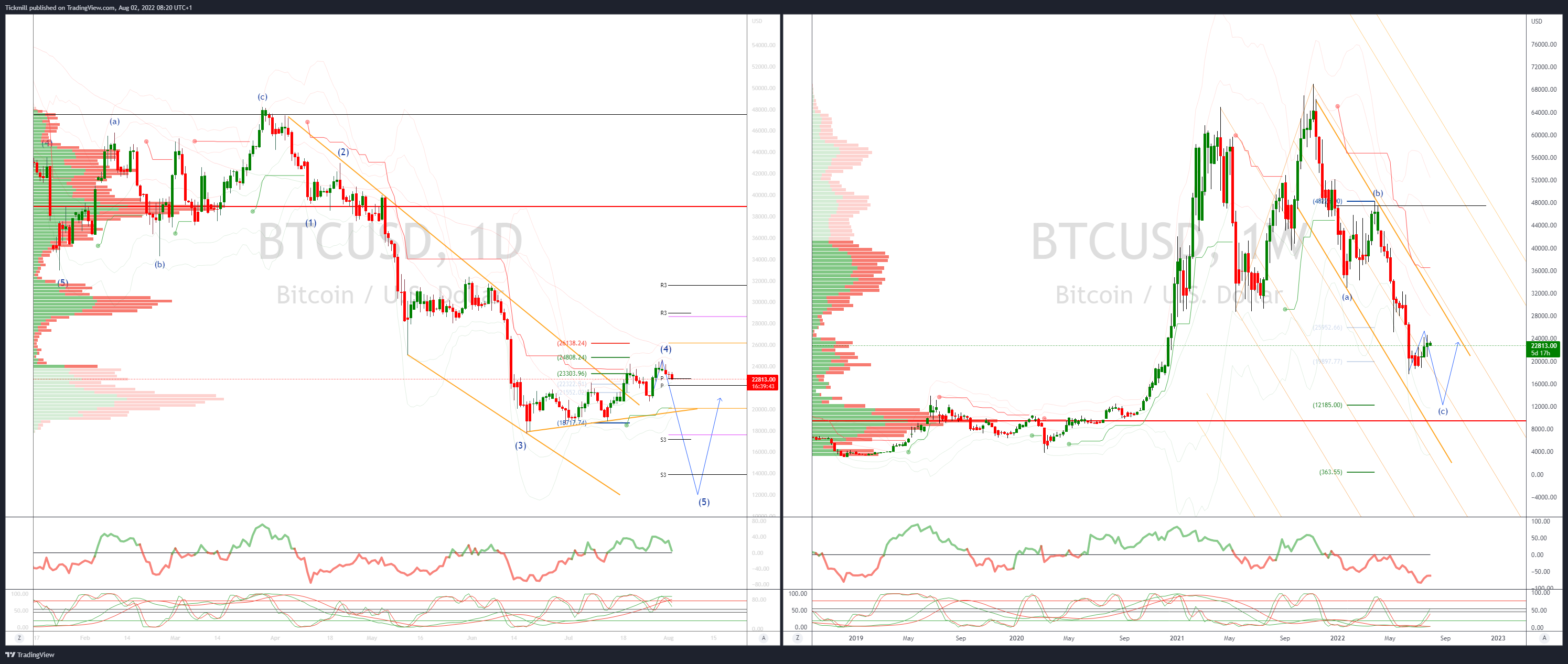

BTCUSD Bias: Bearish below 25.3K

- BTC sub 23k

- Risk aversion underway, largely due to US-China tensions

- US Speaker Pelosi expected to visit Taiwan Tues...

- Potential for aggressive China reaction spooks stocks

- Bulls need a close above 25k to gain significant upside momentum

- Closing below 21k would be a noteworthy downside development

- 20 Day VWAP is bullish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!