Bullard Explained why he Wants to be “Ahead of the Curve”

The US manufacturing sector "seems to be already in a recession," and overall economic growth is expected to slow "in the near future," St. Louis Federal Reserve Bank President James Bullard said Friday explaining why he voted against at the last meeting advocating more aggressive steps toward easy credit.

The Fed slashed the rate by a quarter percentage point to 1.75-2.00% on Wednesday, for second time in this year to offset the slowdown in global growth and the risks associated with the US-China trade war.

However, Bullard argued for a larger cut, citing such issues as persistently weak inflation, soured market-based inflation expectations (as can be concluded from the steep bond market rally) as well as the possibility of slowing economic growth.

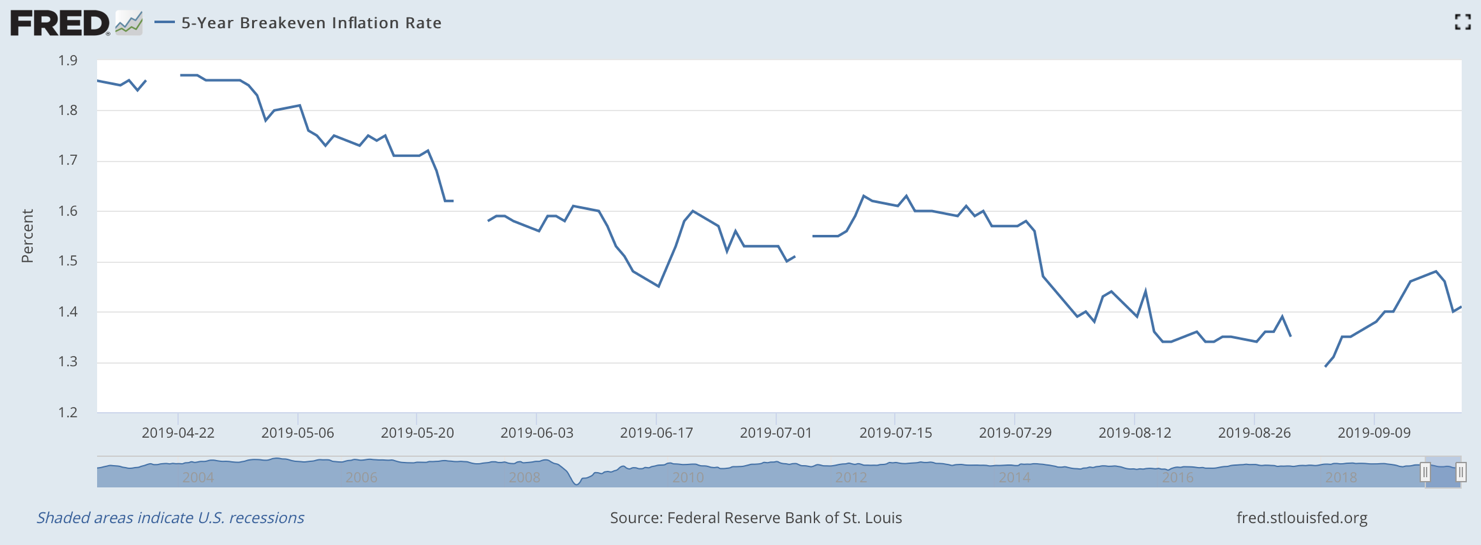

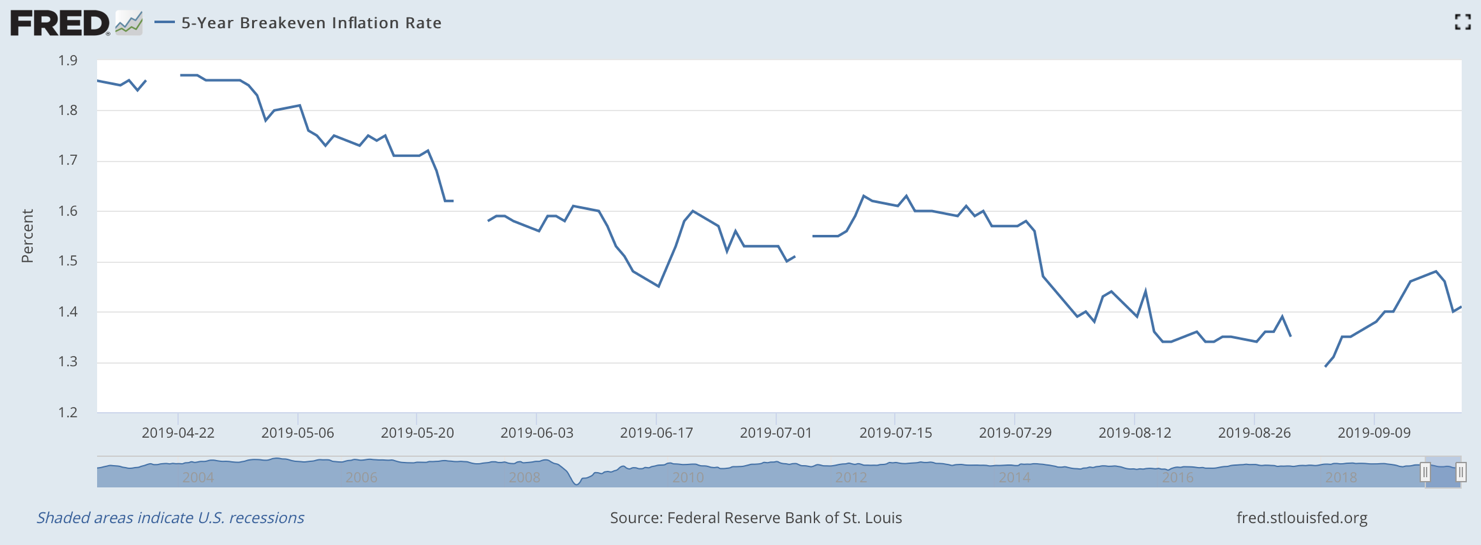

Inflation premium in risk-free bonds declined to 1.29% in August, briefly bounced to 1.5%, but tumbled before the meeting:

A more significant rate cut "would provide insurance against decline in expected inflation and slowdown in the economy, which is subject to increased bearish risks," Bullard said in a statement on Friday.

"In my opinion, this is prudent risk management - aggressively lower the rate now, and then raise it if downward risks do not materialize”.

Bullard noted that, the balance of risks shifted to the downside - from data indicating a reduction in the manufacturing sector to the situation in the bond market, where an inversion of the yield curve indicated market worry about short-term prospects of the interest rates.

Please note that this material is provided for informational purposes only and should not be considered as investment advice.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.