Bitcoin Options Volatility Risk Today

BTC Options On Watch

Bitcoin prices continue to grind higher as we approach the weekend. Today, around $8 billion in BTC option expiries are due to roll off, creating plenty of volatility risk. The good news for bulls is that the put-call skew beyond today’s expiry, favours further upside in BTC, meaning that there should be a good amount of rollover today, keeping BTC on a positive trajectory.

Seasonality

Seasonal trends in BTC point to October as typically being among the three bets months for the market, meaning that we could be seeing an early push higher here to set up a breakout move over October. The recent wave of stimulus announced in China has helped boost broader risk appetite which is also feeding into positive BTC sentiment here.

US Inflation Data

Alongside options flow, focus today will also be on the latest US data. Core PCE for August is due and Bitcoin bulls will be hoping for a weak figure to keep the focus on further Fed easing. Pricing for a deeper cut in November has weakened over the last 24 hours in response to mixed Fed commentary and some better US data. However, if we see PCE today coming in below forecasts, this could well tip pricing back in favour of a bigger hike, which should put pressure on USD near-term and allow BTC room to push higher.

Technical Views

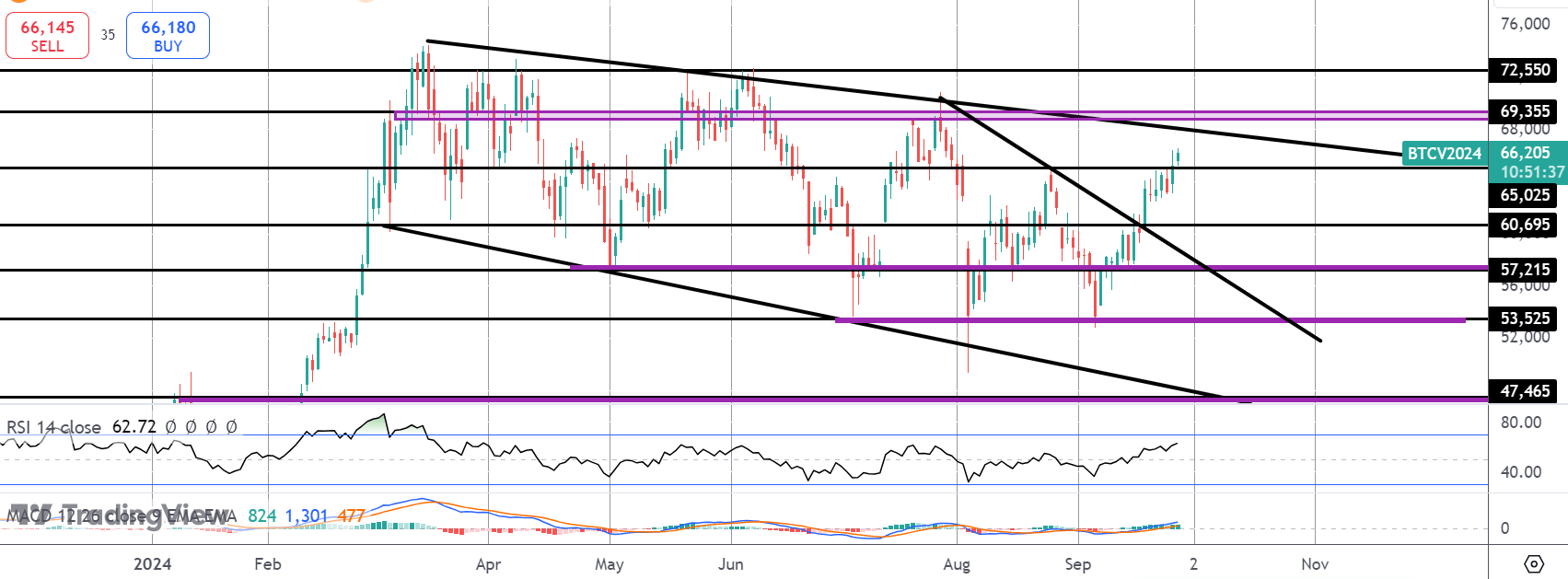

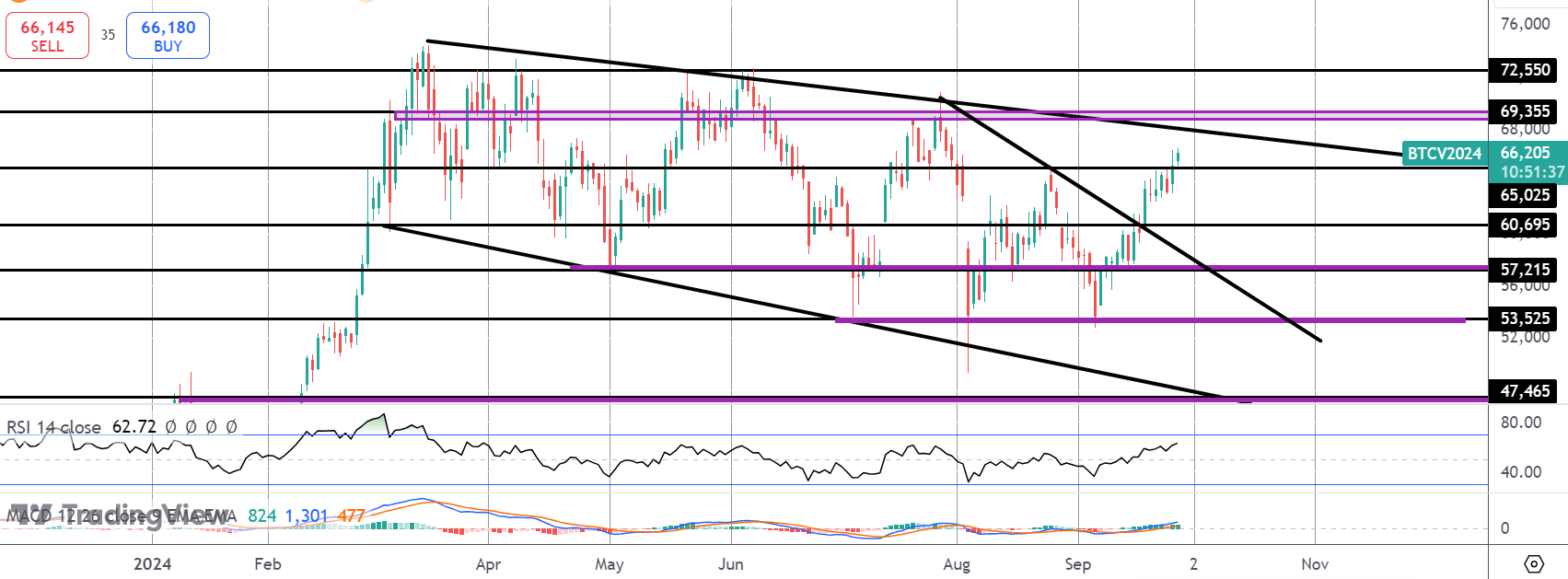

BTC

The rally in BTC has seen the market breaking out above the bear trend line and above the 65,025 level August highs. With momentum studies bullish, price is now close to testing the bear channel highs and the 69,355 level. This is a big resistance area for the market and a break higher will be firmly bullish, pointing to increased chances all new highs in coming weeks. To the downside, 60,695 will be key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.