Bitcoin Boosted by US/China Trade News

BTC Recovering on Friday

Bitcoin prices are fighting to recover today after a fresh push lower yesterday as risk assets recoiled in response to fresh tensions between Trump and Musk. The two were seen trading public barbs on social media marking a deepening of the rift between the two. Crypto prices were hurt across the board yesterday. Musk’s close association with Trump over his presidential campaign was seen as a positive omen for the crypto market given Musk’s championing of the sector, However, with Musk now falling from presidential favour, traders sense that Trump will be less inclined to help the crypto sector.

US/China Talks

Despite the intensifying spat, crypto prices are staging a tentative recovery today helped by better optimism around US/China trade talks. Following a phone call between Trump and Xi yesterday, Trump noted that the two sides have agreed to continue trade negotiations. While little was offered in the way of details, markets are taking some reassurance from this news. However, unless any further signs of progress are seen soon, risk sentiment is likely to weaken again putting BTC at risk of a deeper push lower.

US Jobs Due

Looking ahead, focus today will be on US jobs data. If a fresh drop is confirmed in the NFP print, this should further support BTC by way of elevating near-term Fed easing expectations. However, any upside surprise in today’s data could see risk sentiment weaken again, as traders scale back near-term rate-cut calls.

Technical Views

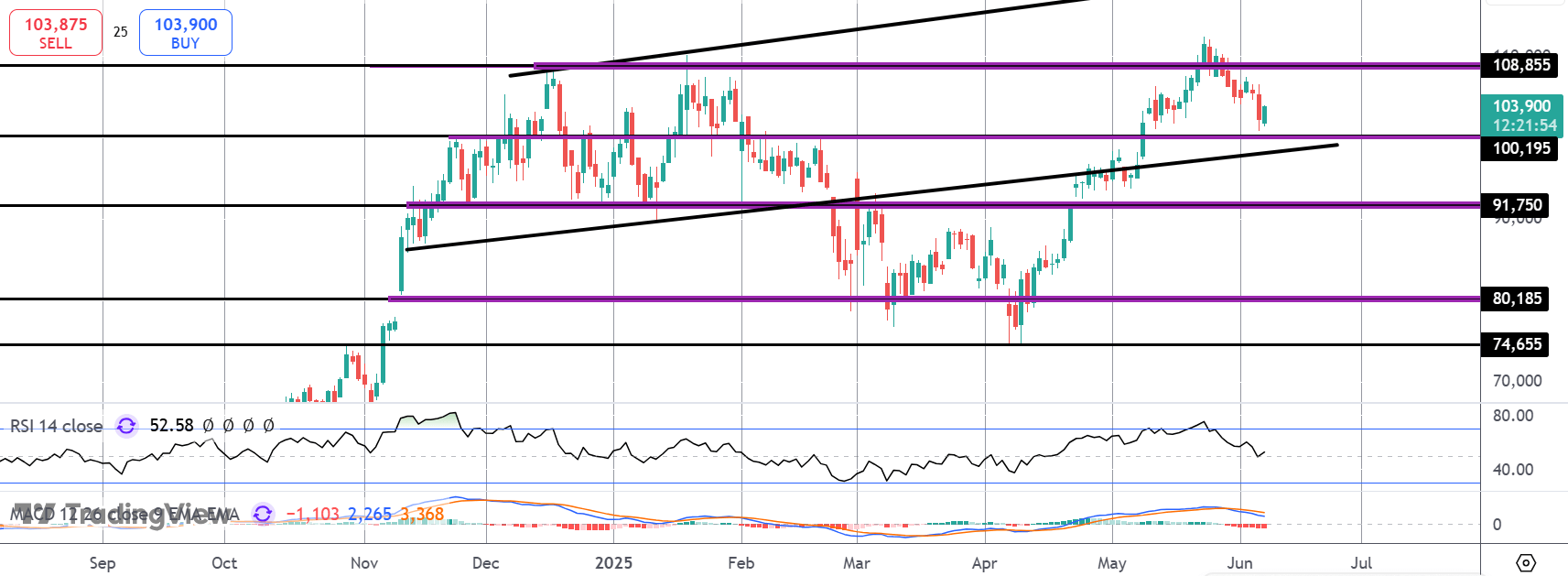

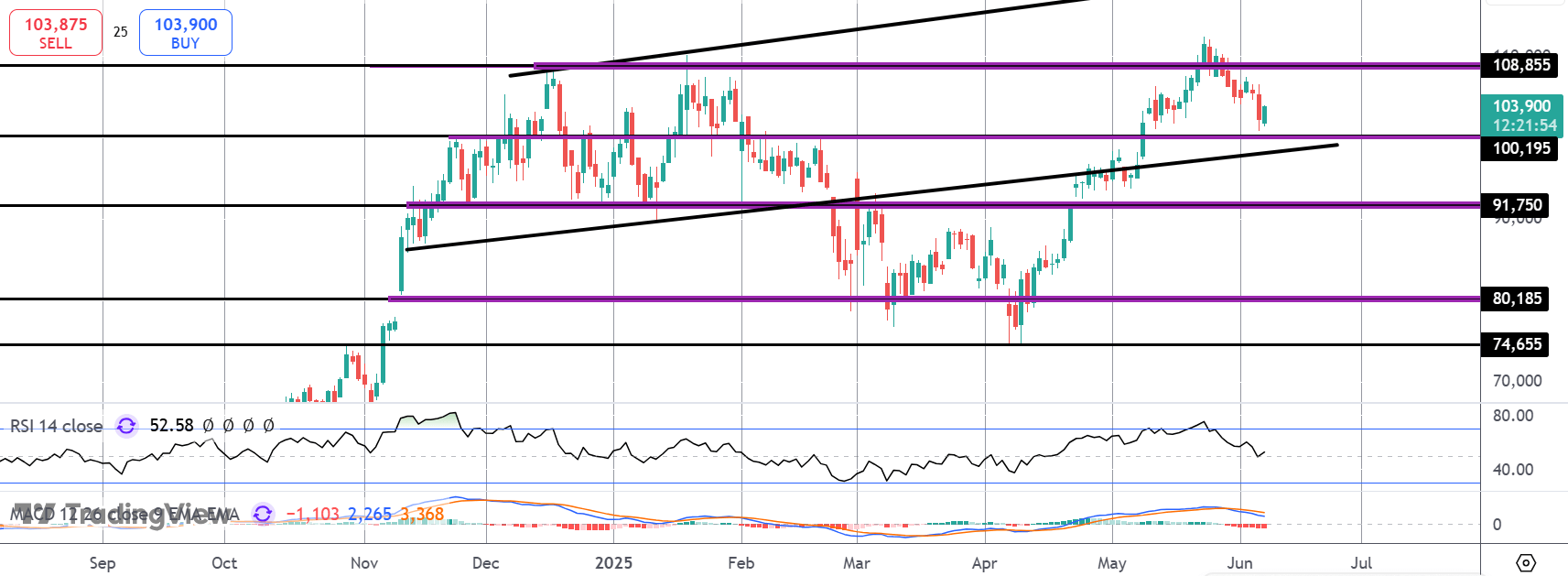

BTC

The sell off in BTC has stalled for now ahead of a test of support sat the $100k mark and bull channel lows. While this area holds as support, focus is on a fresh push higher and a further test of the $108,85 level. Below there, focus shifts to deeper support at the $91,750.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.