Aussie Drops As RBA Rate Cut Bets Grow

.png)

Aussie Inflation Falls

The Australian Dollar has come under fresh selling pressure today on the back of weaker-than-forecast inflation data overnight. While the annualised headline CPI rate was seen rising to 2.5% from 2.3% prior, the quarterly readings (both headline and trimmed mean CPI) fell below forecasts. On the back of the data, expectations of a forthcoming RBA rate cut in February have risen, putting pressure on the Antipodean currency. This lift in market expectations reflects a shift among institutional investors recently with Westpac now forecasting a rate cut next month. Australian Treasurer Chalmers has added to dovish sentiment this week also, noting his view that the worst of Australian inflationary pressure has now passed.

Fed Vs RBA

Given the weakness in AUD on the back of those inflation readings, the stage is set for a deeper decline if we hear any hawkishness from the Fed later today. With the recent dovish shift in Fed pricing, there is big upside risk for USD today is the Fed is seen pushing back against this dovish view, diluting near-term rate cut expectations. If seen, this would create clear divergence among traders outlook on the RBA and the Fed, leaving plenty of room for AUDUSD to weaken near-term particularly given the weaker commodities outlook amidst an uptick in tariff rhetoric from Trump this week.

Technical Views

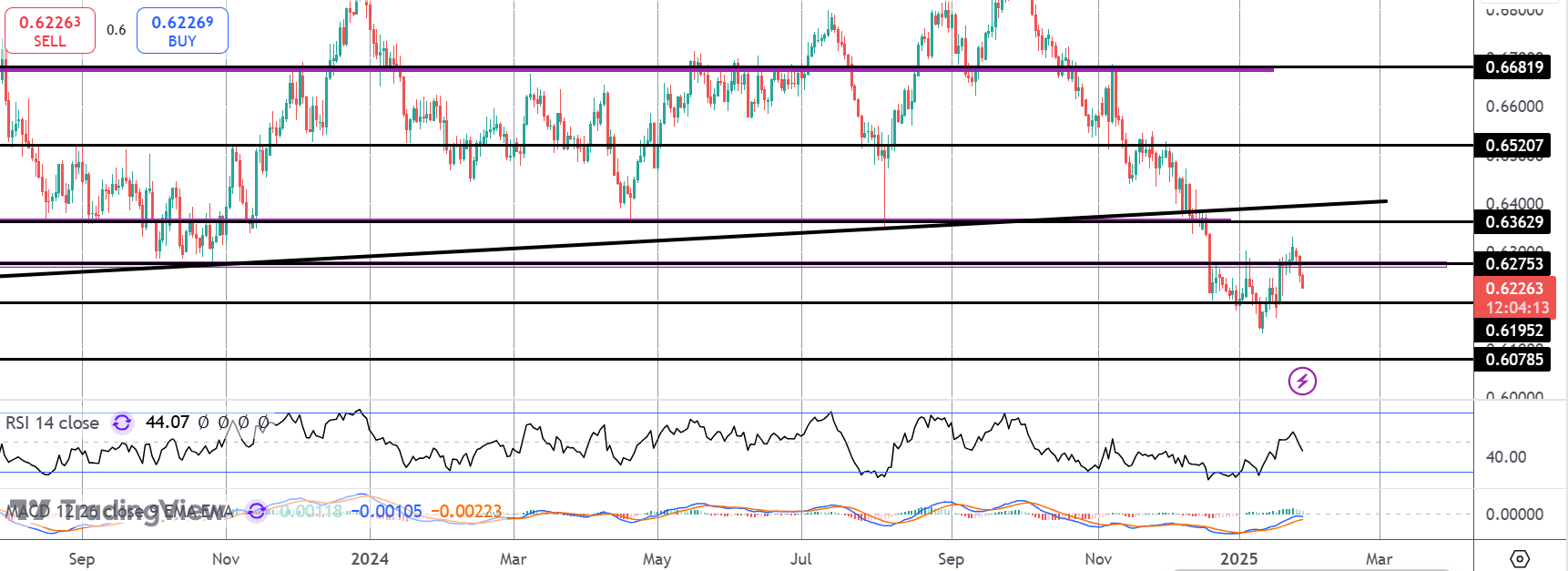

AUDUSD

The failure to get back above the .6275 level opens the way for a fresh drop lower, in line with weakening momentum studies readings. The .6195 level will be the next support to watch with .6078 the deeper target for bears. In the Signal Centre today we have a sell limit at .6260 suggesting a preference to fade any pop higher and play for resumed downside.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.