AUDUSD Testing Key Level

Aussie Slides

The Aussie remains under pressure on Thursday as the reversal lower from .6549 continues to gather pace. The slide echoes the softness we’re seeing across the broader risk-complex with AUD tracking the move lower in commodities. Weaker copper prices are certainly a function of this move as USD continues to hold up ahead of Fed chair Powell’s keenly awaited Jackson Hole symposium speech tomorrow. The FOMC minute slats night failed to provide any fresh movement in USD and were judged as having reduced relevance seeing as the meeting came before the big NFP surprise at the start of August.

RBA Easing Expectations

On the Aussie front, weaker inflation data is keeping RBA easing expectations in focus here. The RBA cuts rates once again at its last meeting, the third .25% cut this year and with inflation now back at its lowest level since 2021 (though still above the RBA target), traders are forecasting at least one further cut this year. This narrative should keep AUD pressured lower near-term. However, if Powell delivers a dovish signal on Friday, this could easily spark a fresh wave of selling in USD which should bolster risk appetite, lifting AUD as commodities prices bounce back. If Powell fails to deliver such a signal though, USD is vulnerable to a short squeeze which will exacerbate the current AUD decline.

Technical Views

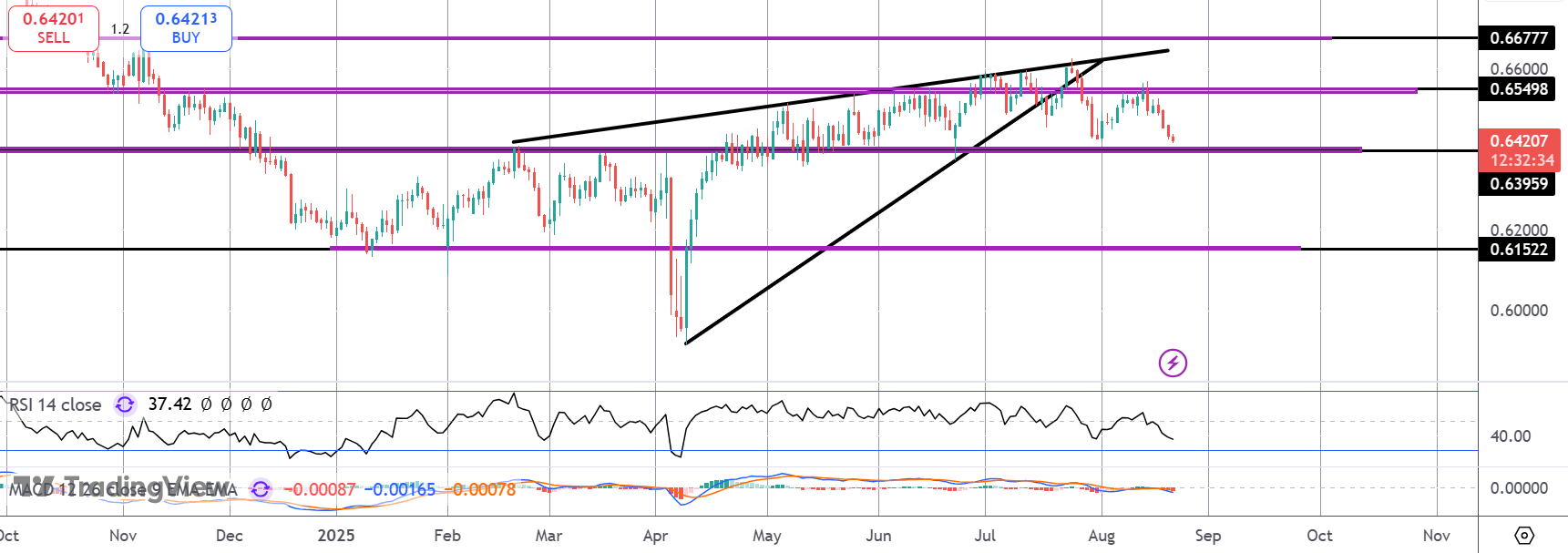

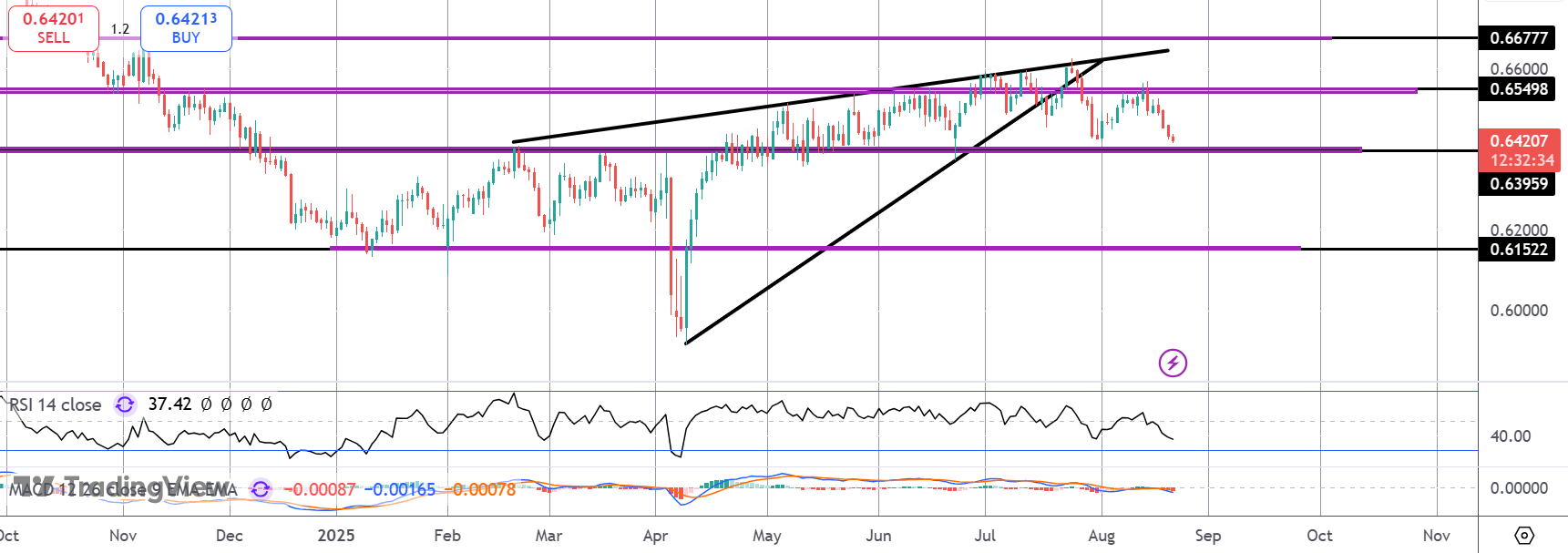

AUDUSD

The breakdown from the rising wedge is resuming here following the failure at .6549. Price is now testing the big .6395 support level. If the market breaks lower here, focus is on a continued decline towards .6152 in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.